The 2024 DGTL Study sheds light on five key findings that will guide your thinking for your digital strategies in 2024. This second edition reaffirms the importance of crafting a research research-driven digital strategy. Leger DGTL converts insights into tailored strategies, seamlessly aligning with the unique expectations of our clients’ audiences, unlocking maximum potential and return on investment.

While they can’t guarantee the end of your sleepless nights, this study serves as your guiding light, illuminating the path to insights that provide certainty and ease of mind addressing the pressing questions that keep you awake night after night.

What Keeps You Up at Night?

Research empowers a deeper understanding of your audience’s needs and expectations, including:

→ Actively used platforms;

→ Top -performing content types;

→ Preferred means to connect with brands;

→ Brand perception insights;

→ And so much more.

A bit of background. The 2024 DGTL Study represents a step forward in our research efforts. This year, we introduced a refined questionnaire designed to better capture the diversity of the communities we survey, aligning with Leger’s commitment to diversity, equity, and inclusion (DEI). We also surveyed Canadians and Americans to enrich the depth of the insights presented in our study.

By improving our questions and including additional audiences, we create a more inclusive environment, which leads to better insights and more meaningful research.

What? Online survey of 4,079 respondents available in English or French.

When? Data collection from September 5 to October 4, 2023.

Weighting: Canadian results were weighted by gender at birth, age, region, mother tongue, education and presence of children in the household. U.S. results were weighted according to respondents’ gender at birth, age, region, mother tongue, education, number of individuals in the household and ethnicity (Hispanic or not), according to Leger’s weighting standards.

1. Online Habits and Behaviours

The new generations are transforming the digital landscape. It’s not just fashion that changes from one generation to the next; online behaviours evolve as well. While it’s important to continue engaging with your more mature audiences, keeping an eye on and drawing inspiration from what younger people are doing is an excellent strategy: one day, these young people will become your target audience and bring with them all their digital knowledge and habits.

The digital world is evolving, prompting Canadians to adapt their presence on different platforms.

This year, some digital consumption habits persist. For example, Facebook, YouTube, Instagram and Pinterest are not recording any significant increases or decreases in membership levels. However, other habits are emerging: a growing number of Canadians are joining LinkedIn, TikTok and WhatsApp.

Although it still ranks first among the platforms that Canadian social media users would keep if they could choose only one, Facebook is gradually losing momentum. Of the 21 percent of internet users who prefer Facebook, 73 percent are aged over 45. Conversely, those under 45 would prefer to keep Instagram. While other platforms maintain their rank compared to last year, WhatsApp stands out with an increase in digital platform users who would keep it as their sole platform.

First Generation Immigrants

WhatsApp is very popular with first first-generation immigrants. While Facebook still dominates the social media landscape in Canada, WhatsApp wins hands down when it comes to first first-generation immigrants alone. If done in a non-intrusive way, integrating WhatsApp into a brand’s strategy can strengthen the relationships with audiences.

Among first-generation immigrants:

- 75 percent have a WhatsApp account

- 34 percent with an account on at least one platform would prioritize WhatsApp if they could only keep one platform

- 48 percent use WhatsApp at least once a day and 61 percent use it at least once a week

Recommendations include using a multilingual approach to communicate with each of your audiences in their mother tongue, promoting understanding and inclusion. Develop content focused on family, culture and shared experiences, in a context where family conversations are often at the heart of communications on WhatsApp. Ensure responsive customer service to build trust and engagement with your audiences.

Influencers: Content Appreciated and Credible

Influencers are often very close to their followers: including them in your digital strategies can allow you to reach audiences that you might not be able to reach with your usual channels.

Thirty-five percent of Canadians follow influencers, a significant increase from last year (31 percent in 2022). Among these followers, 68 percent hold a positive perception of the credibility of influencer content (66 percent last year).

Podcasts

Canadians are listening and not just reading or watching. Audio is on the rise as more of us are streaming music and listening to podcasts on a weekly basis than we were in 2022.

Work

We are looking for work. At any given time, 21 percent of Canadians are job seeking. Catalyzed by labour shortages, the economic context, and the evolving motivations of employees, the professional dimension of the Web is gaining momentum. Job seekers acknowledge the value of social networks in their job search, and brands should establish solid strategies to promote their employer brand and attract top talent in their respective industries.

2. Emerging Platform Adoption

Canadians are inclined to sign up for new platforms, but consistent usage is not guaranteed. New platforms are both opportunities and nightmares in the daily lives of marketing professionals − we all remember the madness when Threads was launched. So here are a few statistics to help you answer your boss’ question: should we be on [insert name of new platform here]?

Threads and BeReal seem to have been born out of a growing desire for authenticity in the content and interaction that occurs online. WhatsApp and Discord are a notch above, providing spaces for instant, raw communication. All these platforms want to capture the essence of spontaneity and transparency, offering users spaces where they can share moments of their lives in a more immediate and sincere way.

The platforms that have seen more unsubscribes than subscribes are Twitter, Twitch, Pinterest and Snapchat. With a third of the population having an account, TikTok continues to gain ground. Contrary to popular belief, its appeal is not limited to GEN Z; millennials (millennials (25 25-44) have also found their place on TikTok.

Despite the initial craze, Threads and BeReal have failed to engage their users, leaving a trail of fading interest. For 2024, caution is advised: the initial appeal of these platforms is proving to be more fleeting than deep deep-rooted, requiring strategic consideration before any investment.

How do you determine whether a new platform is worth investing in in? The emergence of new platforms undoubtedly represents a major challenge for marketing professionals, who find themselves juggling their desire to innovate with the need to develop sustainable, carefully executed marketing strategies.

Evaluate the Type of Content Posted

Determine whether the platform is aligned with your brand’s content strategy and objectives. Some platforms are better suited to visual content, while others are more focussed on text or video.

Evaluate User Profiles

Assess whether the demographics of the platform’s users match your target audience and check their level of engagement.

Consider TikTok

Its ever-growing popularity makes it an excellent platform for reaching the working population and younger audience. In 2023, about one third (31 percent) of the Canadian population is on TikTok. Canadians who joined TikTok this year primarily did so for entertainment (48 percent), to follow interesting accounts (44 percent), or to keep up with trends (32 percent).

3. Digital Fatigue and Anxiety

Digital fatigue and anxiety are two very real phenomena. Canadians excel at the art of online scrolling. But with this habit comes boredom, anxiety and doubts about content credibility. In this context, the desire to connect and communicate with our community, whether real or virtual, is even stronger, as is our urge to follow people and accounts that make us feel good.

A less enjoyable digital presence. Information overload, constant notifications, pressure to stay connected, negative content, multiplicity of platforms, data protection issues…Canadians’ distrust of content and platforms is trending upwards compared to last year, reducing their enjoyment of the Web.

Answers to questions changed:

- I like to visit the Web for entertainment or inspiration? 76 percent (down from 80 percent in 2022)

- When I browse a digital platform I am very suspicious. 60 percent (up from 56 percent)

- I find it difficult to discern the real from the fake on digital platforms. 49 percent (up from 45 percent)

- The Web is a source of stress for me. 23 percent (up from 21 percent)

- I am open to sharing more personal information on digital platforms if this enhances/personalizes my online experience. 22 percent (down from 25 percent)

About a quarter (23 percent) of the population reports feeling stressed by digital media. Yet only 15 percent of Canadians with an account on at least one digital platform have implemented mechanisms to limit their time on social networks. This disparity suggests that, despite the stress, reducing online time may not be the preferred solution for Internet users. What if, instead, they seek to enhance the quality of their content, making their online experience more meaningful and less stressful? Brands could play a crucial role in creating more engaging, informative, or entertaining content to meet this demand.

Less Bogus Content

Lack of interest in posted content is the main source of digital fatigue. What’s more, among those who left a social media platform in the past year, at least 40 percent cited a content content-related reason.

Reasons for quitting a platform include lack of interest in content (40 percent), doesn’t suit the viewer anymore (31 percent) and for privacy and security reasons (27 percent).

What’s more, people worried about:

- 26 percent: Toxic content

- 24 percent: No longer need the platform

- 21 percent: Lack of time for this platform

- 21 percent: To reduce my stress/lessen the impact on my mental health

- 19 percent: Change in the platform’s vocation or policies

- 14 percent: My social circle is no longer there or is no longer active

- 12 percent: The accounts I follow are no longer there or active

- 8 percent: Other reason(s)

Despite this fatigue, Internet users seem to feel good when they engage in meaningful conversations. Brands have a vested interest in developing human, positive and enriching communication strategies − a ray of hope in an increasingly toxic digital universe.

People who joined a new platform included:

- 43 percent: To connect or communicate with people around me

- 33 percent: To follow accounts I like

- 27 percent: Interest in content

- 22 percent: To entertain or inspire myself or pass the time

Other reasons included to keep informed, keep up with trends, be part of a community, meet new people, for a specific need, to express themselves, and others.

How can I make my content more engaging?

Despite digital fatigue and anxiety, Internet users stay connected. So, it’s up to brands to create content that will be perceived as interesting, relevant and value-added.

Humanize Your Brand

Internet users prefer to interact with people rather than companies, so, give your brand a personality to create a more authentic connection.

Put Aside Overly Polished Content

Create User Generated Content (UGC), post photos without filters or graphic elements. Use the functionalities (typography, colours, stickers, etc.) specific to each platform.

Focus on Conversations

Integrate messaging apps in your strategy: WhatsApp, Chatbot, SMS, etc.

4. Online Habits

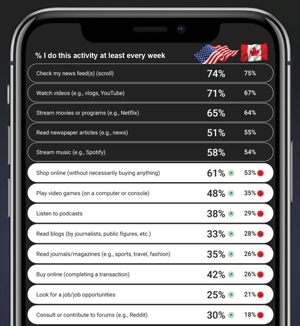

The Leger report includes extensive information about American online habits, but we’re going to focus on the comparison of American and Canadian behaviour that was revealed in the research. There are some significant differences.

Besides being present on various platforms, Americans participate in a diverse array of online activities. While some marketers might perceive this plethora of choices as a potential challenge, we view it as a tangible opportunity for brands to enhance and diversify their strategies. Moreover, over half of Americans (61 percent) admit to “virtual window shopping”, presenting an opportunity to leverage in retargeting strategies.

COURTESY LEGER DGTL

Yes to Advertising, as Long as it’s Well-Targeted

COURTESY LEGER DGTL

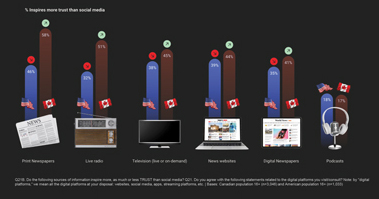

A High Level of Trust in Social Media

The credibility of traditional media is being called into question. The polarization of information and concerns about bias are prompting Americans to turn to social media as more credible sources of information. They generally have more confidence in platforms, even emerging platforms, and fewer (37 percent in the U.S. vs. 49 percent in Canada) say they have difficulty recognizing true from false on digital platforms.

Inspires More Trust Than Social Media

COURTESY LEGER DGTL

Should I target Canadians and Americans in the same way?

The American market is both mature and pioneering. By monitoring what is happening with our southern neighbours, we can identify strong indicators that help anticipate upcoming trends in Canada. If you are a Canadian brand, this gives you the opportunity to integrate these trends into your strategies and gain a competitive edge.

Hypersegment Your Platforms

Expand the platforms where your brand is active and tailor your strategy for each. The diversity of platforms become an advantage for your brand, helping you reach a more targeted audience and solidify your place in the digital landscape landscape.

Embrace Content Repurposing

As Americans are on different platforms and consume different types of content, repurposing (and adapting) your different content can help you engage with your audiences more effectively.

Segment your audiences to better personalize your content

Americans welcome advertising: capitalize on this receptiveness to carve a distinctive space in their minds by presenting content and ads that genuinely align with their interests, needs, and their position in the buying journey.

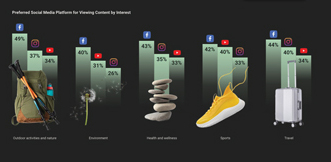

5. Platform Usage by Industry

Preferences for digital platforms vary significantly according to demographic segments and user interests. This highlights the importance of a targeted digital strategy to effectively reach different audiences on the channels they use most.

Usage Trends: Nature, Health & Wellness, Sports & Travel

Who hasn’t dreamed of being on a beach in the Bahamas or hiking in the Dolomites after seeing a Reel on Instagram? With its visual focus, Instagram is favoured by travel and nature enthusiasts (67 percent of 16-24 year olds and 59 percent of 25-44 year olds). Not surprisingly, the age under 45 prefers this platform for consuming content. As a platform to long-form content, vlogs and educational tutorials YouTube is a great reference for sports content.

Preferred Social Media Platform

COURTESY LEGER DGTL

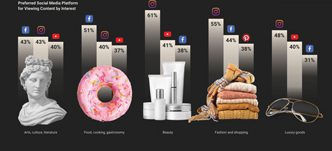

Usage Trends: Arts & Culture, Gastronomy, Beauty, Fashion, Luxury Goods

COURTESY LEGER DGTL

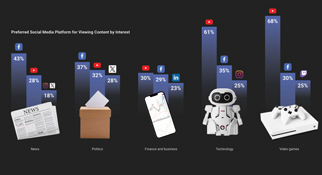

Usage Trends: News, Politics, Finance, Technology, and Video Games

COURTESY LEGER DGTL

5. Key Findings to Guide Your Strategies for for2024

New generations are reshaping the digital landscape. Younger people are increasingly moving away from Facebook, with many now following influencers on Instagram. In time, these younger demographics will have significant purchasing power — it’s crucial to evolve alongside them.

While the registration rate for emerging platforms is high, actual usage remains low. On the contrary, TikTok continues to expand its reach, now attracting more than just Gen Z. It’s seeing increasing activity from those aged 44 and under.

The phenomena of digital fatigue and anxiety are very much a reality. Despite this, people are staying online, seeking interactions that are more human, positive, and fulfilling.

The online presence is diverse, and often sets trends. Keeping an eye on developments in the U.S. can help in identifying upcoming trends and incorporating them into your strategies ahead of time.

The choice of platforms varies greatly based on interests. Once you understand your audience’s interests, direct your marketing efforts toward the platforms where they are most active.

The new DGTL Interactive Report, developed in close collaboration with our research and analytics teams, represents a significant advancement in effectively developing your marketing plan.

The DGTL Interactive Report offers you the ability to filter data from the DGTL 2024 study, allowing you to better understand the actual preferences of your audience. Whether by age group, gender, region (province or country), or interests, you can precisely select the platforms on which to invest your resources with confidence. https://legerdgtl.com/en/dgtlstudy