Financial Brands That Earned Triple-A Loyalty Ratings: Discover, PayPal, TurboTax, TD Bank, Chase, American Express, and Vanguard

NEW YORK, NY–Customer brand loyalty has survived the impact of the COVID-19 pandemic, which imposed a severe stress test on brands, according to Brand Keys 25th annual 2021 Customer Loyalty Engagement Index® (CLEI). The national survey, conducted by the New York-based brand engagement and customer loyalty research consultancy, found that while the pandemic claimed many business and brand fatalities, customer loyalty was not among them.

The Ultimate Loyalty Stress-Test

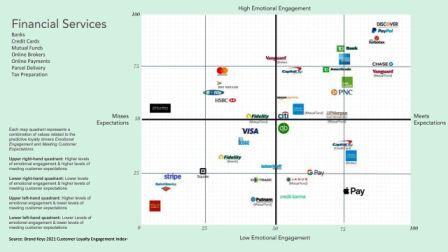

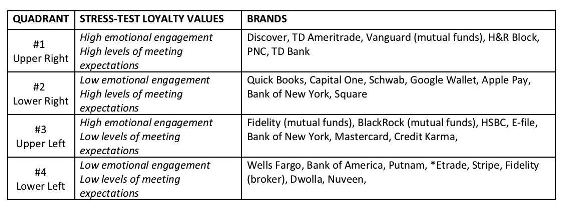

“The new CLEI survey found 2020 marketplace rigors created two loyalty challenges for brands,” noted Robert Passikoff, Brand Keys founder and president. “First, how to enhance brand-to-consumer emotional engagement and, second, how to leverage brand values to best meet customers’ expectations.” This year, to graphically illustrate brand loyalty rankings, Brand Keys created a series of emotional engagement/expectation quadrant maps to delineate brand loyalty positions in the marketplace based on the two stress-test dynamics.

Loyalty Positions In The Financial Sector

The 2021 CLEI examined 94 categories and 855 brands. Financial brands (in 7 categories: banks, credit cards, mutual funds, online brokers and payments, & tax preparation) representative of each of the quadrant values included:

The Loyalty Map Multiple

The Loyalty Map Multiple

Each quadrant on the map represents a combination of values related to predictive loyalty drivers: Emotional Engagement and Meeting Customer Expectations. “Ideally,” said Passikoff, “You want consumers to feel your brand engenders high emotional engagement and meets their expectations as completely as possible. Brands able to do that are six times more likely to create loyal customers, and loyal customers are six times more likely to give a brand the benefit of the doubt in tough circumstances.”

Customer Desire and Brand Delivery

“Emotional engagement, the result of effective marketing communications that increases a brand’s equity, results in customers behaving more positively toward the brand,” noted Passikoff. “Consumer expectations, a key dimension of customers’ brand belief-systems, are unconstrained customer desires. Expectations increase on average 22 percent a year, yet brands typically manage to achieve only a seven percent increase – a big gap between customer desires and brand promises to deliver.

A Weakened Economy and Broken Supply-Chains

“A weakened economy and a shift to working from home changed the consumer paradigm. Desperate times calls for desperate choices due to lack of funds or product availability. Purchase of ‘new’ or ‘alternative’ brands represents basic need, not a lack of customer loyalty. During pandemics consumers will compromise, but they still continue to demand that their expectations be met,” noted Passikoff. “But lack of availability does not denote a decline of brand loyalty. Yes, being in-stock matters as regards sales, but loyal customers are more likely to stick with their favorite brands through difficult times and, in a more stable marketplace, will wait for them or will actively seek them out.”

“What’s incontrovertible is that the 2021 Customer Loyalty Engagement Index confirms brands that best meet consumers’ expectations, and are capable of sustaining emotionally engaging relationships, always see enhanced loyalty – and the market share and profits that come with it,” added Passikoff.

Methodology

For the 2021 CLEI survey, 75,804 consumers, 16 to 65 years of age from the nine US Census Regions, self-selected categories in which they are consumers and brands for which they are customers. This year Brand Keys examined 94 categories and 855 brands. Forty percent were interviewed by phone and 60 percent were interviewed online.

Brand Keys uses an independently-validated research methodology that fuses emotional and rational aspects of the categories, identifies four category-specific path-to-purchase behavioral loyalty drivers, and identifies the values that form the components of each driver, along with their percent-contribution to engagement, loyalty, and profitability.

This year Brand Keys organized brand loyalty standings via psycho-emotional loyalty mapping to identify where brand-specific loyalties fall, help visualize loyalty decision-path, and clarify brand positions in the marketplace. Consisting of two axes, one representing the degree of emotional engagement a brand engenders and the second, a measure of the brand’s ability to meet customer expectations, allow brands to focus marketing efforts to better manage loyalty and competitive challenges.

Brand Keys’ research technique, a combination of psychological inquiry and statistical analyses, has a test/re-test reliability of 0.93 and produces results generalizable at the 95 percent confidence level. Brand Keys loyalty assessments correlate with positive consumer behavior in the marketplace at the 0.80+ level. It has been successfully used in B2B, B2C, and D2C categories in 35 countries.