Have marketers lost their ability to future-proof their budget?

By Mo Dezyanian

By Mo Dezyanian

Two years ago, we sought to better understand the relationship between CMOs and CFOs.

Our study, amongst many other things, revealed that those departments speak different languages, especially when it comes to budgets. Most importantly, it revealed how CFOs view the role of marketing. To quote one:

But the past two years have not been easy on marketers. First a pandemic that stopped the world overnight. Then disruptions to global logistics. Then a talent crunch. Underscoring this are nuanced cultural conversations that are more fragmented than ever before.

All this made the job of allocating resources to marketing nearly impossible.

The biggest challenge is still ahead. Today’s economic uncertainty might be the highest hurdle to marketers in decades.

During the recession of 2008-2009, a sharp decline in cost of borrowing and deflationary forces countered the temporary rise in unemployment.

Household disposable income continued to grow. Consumer confidence trended steady. In short, people borrowed more to spend.

But that won’t be happening this time around. Inflation and the high cost of borrowing are squeezing wallets. And when wallet sizes shrink, so do marketing budgets. We wondered if marketers had improved relationships with their most critical ally in the boardroom over the past two turbulent years.

So we asked 43 Canadian CMOs and CFOs a series of questions about how they set budgets, how they approve them or seek approvals. Short answer? Results remain positive. Finance and marketing are still aligned on the big picture. Collaboration is high.

But…marketers are less confident in their ability to look ahead, and CFOs have lost trust in marketing’s ability to see through the fog of change.

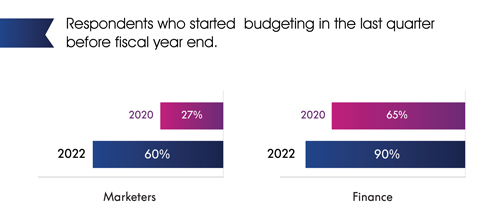

Thank goodness there are marketers at the boardroom table to look into the future!It seems like everyone is looking into the past. Respondents who started budgeting in the last quarter before fiscal year end.

Marketers

Budgets are being set quicker than they were pre-Covid. Two years ago, the majority of CMOs started budgeting 4-6 months before the new fiscal year. Meanwhile, two-thirds of CFOs came into the process a bit later, about 3 months before the new fiscal year.

That has changed. Now, 55 percent of CMOs start budgeting 2-3 months out, and only 10 percent of CFOs get involved in the budgeting process sooner than 3 months before the new fiscal year. While both parties continue to maintain that budgets are set collaboratively, it seems that budget setting has become a quicker exercise across the board. What does this mean for marketers? Are we less certain about the future? Perhaps, though marketers would benefit from going back to starting budgeting earlier.

Finance

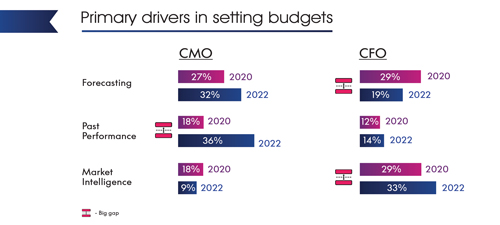

Two years ago, marketers agreed that forecasting was the number-one way they set marketing budgets. Only 18 percent of marketers said past performance was the primary driver for budgeting. Now, 36 percent of marketers (i.e. most) rely on their past performance to set new budgets. It should be mentioned that more marketers are still using forecasting, too. 32 percent compared to 27 percent.

Most finance leaders, on the other hand, still think market intelligence is the most important factor in budgeting (33 percent). But they have also lost confidence in forecasting. Only 19 percent use forecasting to budget, vs. 29 percent two years ago.

In the past 2-3 years, as the economy, politics, and culture have transformed at an unimaginable pace, it has become more and more difficult to forecast business performance. Folks on both sides of the boardroom table do not trust that what is true today remains true tomorrow.

Uncertainty plagues budgeting.

Yet both of our selected cohorts crave certainty. CMOs (28 percent vs. 18 percent) and CFOs (27 percent vs. 18 percent) believe that forecasting should be the number one way to determine next year’s marketing budget.

What does that mean for us marketers? Marketers would do well to combine their powers with finance. Use finance’s training in forecasting and fiscal analysis by engaging them earlier in the budgeting process. But with all this uncertainty, how will companies invest in their growth moving forward?

Primary drivers in setting budgets

Good news, It’s not all tension between CFOs and CMOs. More CFOs today think that marketing doesn’t have the budget they need to meet their goals. Marketers of course agree, more than ever. 64 percent think marketing doesn’t have enough

funding; two years ago, that number was 55 percent. Meanwhile the gap in understanding around how to set goals has widened. Marketers are more confident that they have enough information to set goals (73 percent now versus 64 percent two years ago). But finance is just as sceptical as they ever were.

Roughly 6 out of 10 CFOs feel they don’t have enough information to set marketing goals, or don’t know if they do. Foresight is always challenging. But sharing information between those two departments may be the key to unlock the future. Only 57 percent of them thought that marketing budgets were sufficient before the pandemic. At the beginning of the pandemic 82 percent of CFOs thought so.

The crux of the relationship between marketing and finance is the delicate balancing act of short- versus long-term. And in the unpredictable post-COVID world, that balancing act becomes increasingly difficult.

CFOs: Agree that the number one challenge of approving budgets is finding a balance between long-term and short. Yet, two years ago, the CFOs’ greatest roadblock to approving marketing budgets was proving ROI. The good news is that both parties still maintain that insights and research capabilities are the most-needed resources to make budgeting easier.

However, both parties also feel that investment in infrastructure is lower priority.

To us, it says now is the time to lean in to our collective optimism and increase collaboration. Better news yet, 73 percent of marketers believe that they will increase budgets in the next fiscal year. And a whopping 86 percent of CFOs agree with that statement despite economic uncertainty.

Two years ago marketing and finance were aligned on budget timing. Now, budgeting is rushed. As difficult as it may be, aim to start collaborative budgeting earlier, at least 4-6 months before fiscal end.

Forecasting has become the marketer’s number one budgeting challenge in 2022.We recommend that both departments leverage each other’s core strength. Marketing can tap into finance’s forecasting capabilities; finance can benefit from marketing’s proximity to the customer.

Balancing the long and short terms will forever be a point of tension between CMOs and CFOs; the past two years have exasperated that tension. Yes, outlining the long-term effects of marketing for finance is critical now. But don’t forget about the short-term! Two years ago we suggested that you invest in resources to extract insights from the market (via market research), the competition (competitive research), bolstered by available data in your organization. Today we explicitly recommend that you divest from data infrastructure and invest in insights and research talent.

It is now more than ever important that marketers get alignment with finance about what the KPIs are in the future. Finance is still unsure whether you have the right information to determine your success.

Mo Dezyanian is president of Empathy Inc, a media agency shaping media conversation in the industry.