After leaving Air Miles, Metro offers new rewards program at Ontario stores

by Richard Schenker

by Richard Schenker

On Thursday October 24th, Metro will be finally launching Moi Rewards at all their grocery banners in Ontario. Metro has a long history in loyalty in Ontario. Back when they were called A&P, it was their technology team, of all groups, that spearheaded their charge into the loyalty arena, culminating into a long-standing partnership with Air Miles in Ontario.

This spanned over several decades and long outlived the brand transition from A&P to Metro. Metro also operates in Quebec; however, they never secured the rights to issue Air Miles in Quebec due to Air Miles’ exclusive grocer sector partnership with IGA (a Sobeys brand). As such, Metro designed their own proprietary program called Metro et Moi for the Quebec market. It quickly became a highly revered program by its member base. With the decline of the Air Miles Reward Program over the last decade, (prior to its purchase by BMO), Metro decided that it no longer made sense to offer two programs, Moi in Quebec and Air Miles in Ontario. Therefore, they made the long overdue decision to depart from Air Miles and expand a version of Moi Rewards into Ontario.

Moi Rewards Launches

At the beginning of this week, Metro announced that they will introduce Moi Rewards into all of their grocery banners in Ontario, including their discount banner, Food Basics. However, there will be no base earn rate at Food Basics, only bonus points will be offered. This is likely due to the razor thin margins in the discount grocery sector.

The Moi Rewards program will be linked with the RBC Avion Rewards Program allowing members to earn more Moi bonus points on purchases made with a linked RBC credit and debt card to facilitate a faster time to rewards. They will have also created one of the lowest entry levels to start earning a grocery reward at a $4 reward. Members will also be provided with the flexibility of redeeming at $1 increments, as opposed to predetermined reward levels, which differs from PC Optimum. The usual loyalty mechanics such as personalized offers, extra points for items in flyers, special offers for members and exclusive contests are all enshrined in the Moi Rewards value proposition. What is notably different in Ontario is a lower base earn rate than the current program in the Quebec market.

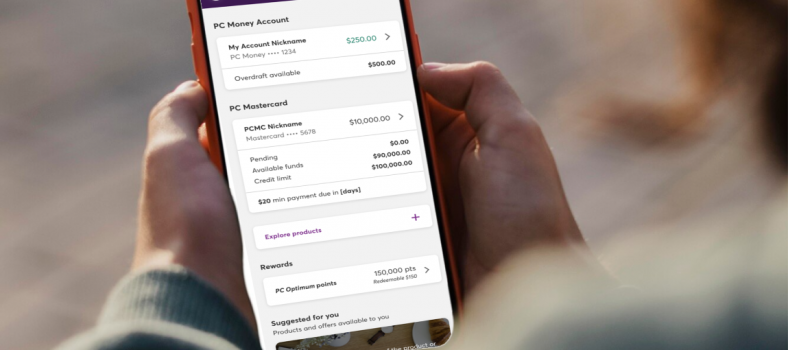

Moi Rewards is the last major grocery loyalty program to launch in Ontario. It is up against some very well established and entrenched heavy weight grocery based/integrated loyalty programs. PC Optimum is likely the most highly penetrated and beloved program in Canada operating in Loblaws banners, Shoppers Drug Mart and Esso. It has a deep footprint across Canada, especially in Ontario and is tethered to several highly success President’s Choice financial assets and innovative digital health and wellness value proposition solutions.

Moi Rewards is the last major grocery loyalty program to launch in Ontario. It is up against some very well established and entrenched heavy weight grocery based/integrated loyalty programs. PC Optimum is likely the most highly penetrated and beloved program in Canada operating in Loblaws banners, Shoppers Drug Mart and Esso. It has a deep footprint across Canada, especially in Ontario and is tethered to several highly success President’s Choice financial assets and innovative digital health and wellness value proposition solutions.

Sobeys, while more newly minted, is now well embedded in the Scene+ coalition program and is part of the owner/operator consortium of that program. Scene+ has an extensive roster of integrated Scotiabank financial products, Cineplex assets and coalition partners, all highly coveted with a multitude of earn and redemption options, beyond just groceries.

Taking a Deeper Look

An assessment of Metro’s Moi program reveals that it checks the standard grocery loyalty boxes. However, as a late comer to the market, one would have expected some loyalty innovation and ingenuity beyond the usual loyalty mechanics and affiliations. While we can expect Metro’s Moi Rewards program to evolve overtime, one would have expected them to launch with something profoundly unique and newsworthy to cut through the Canadian grocery loyalty clutter and truly grab the media and consumers’ attention. Respectfully, it feels more like a “me-too” response launch with several known loyalty mechanics and partnerships. It feels like Metro missed a unique spotlight moment to cutaway from the pact of grocers in Ontario, after decades of affiliation with a declining Air Miles Reward Program.

To compound the above assertions, the grocery sector has been under incredible public and government scrutiny during COVID and especially most recently during the inflationary period. Food insecurity has hit record proportions in Canada. Metro’s CEO and the CEOs of all grocery chains in Canada were summoned to Ottawa and were grilled at government hearings about their high prices and record profits. Price fixing has been admitted to in the industry and grocery brands are finding themselves at an all-time low in trust with grocery shoppers.

So, it is understandable that Metro would introduce reward discounts in their loyalty program to help members save money on their groceries. The inclusion of Metro’s discount banner, Food Basics, is a very positive development for the budget grocery shopper. Having said that, like any other sector, brands need not rely so heavily on the discount as their main point of punctuation in their loyalty programs.

Competitively Different?

While discounting is germane to this sector, it is easy to duplicate, and it is certainly non-differentiating. We also know that consumers have other competing purchasing needs that are at their forefront, most notably in the traditional grocery sector. The typical grouping of grocery customer segments is made up of time starved customers, price sensitive customers, price insensitive customers, scratch cooker customers and health conscience customers, just to name a few. These segments can certainly overlap and are not always mutually exclusive. When designing a grocery led loyalty program, it is important to consider the diverse needs of core customer segments.

Perhaps this will manifest through personalization planned by Metro. However, a well-designed grocery-led program should embody benefits, features and mechanics which foster greater shopping convenience, special access, mitigate customer experience pain points, motivate and recognize members for leading a healthier lifestyle, curate meal solutions, serve up product knowledge, offer time savings perks, facilitate new delivery innovations, generate serendipitous experiences, and create reciprocal unique and innovative brand-aligned partnership value. Finally, it is vital to offer highest value members coveted published or unpublished benefits/perks in recognition of their exceptional loyalty to the brand.

We are witnessing a proliferation of innovation in the loyalty marketplace worldwide. Making a consumer shopping experience easier through apps and AI and introducing new innovative features that transcend pure discounting, can better position brands ahead of their competitors. As an illustration for Metro, there would be enormous value in introducing some or all of the following loyalty program benefits:

• AI personalized generated grocery lists for members using the app

• Weekly curated time-saving meal solutions based on ethnicity, personal and family preferences (linked to purchase incentives)

• Automatic replenishment of food staples

• Motivation and rewards for healthy food purchase decisions

Imagine if a Metro Moi Rewards member could scan any store product on their physical shopping cart screen reader or their app to get product information (or recipes) instantly before they drop the product into their cart. This would permit members to better discern quickly if the product was right for them; high/low in salt, high/low in sugar, high/low in calories, high/low cholesterol, high/low in essential nutrients, etc. Imagine a program that would reward members for consistently choosing products on shelf with a high health quotient as denoted when scanned or displayed on a digital tag on shelf. While these might be some bold ideas and require investment in capital, technology and operations, they are vital to move the market share needle and become less reliant on discounting as a means of engaging customers to shop a particular grocer. These innovative options could also elevate the role of the grocery brand in the mind of customers and give the brand authentic license to expand their circle of trust and relationship with its members.

While price will always play a key role in the consideration set for the grocery sector consumer, traditional grocery banners must begin to reimagine the customer journey experience and what better way to do that than through their loyalty program offering.

Richard Schenker is a highly accomplished customer engagement thought leader, loyalty practitioner and partnership curator who has designed, renovated, and managed some of the world’s leading customer loyalty programs. He has an impeccable track record of success at enriching transactional and emotional relationships between iconic brands and their customers, across multiple business sectors. Richard has spent the first half of his career in senior loyalty roles with the Hudson’s Bay Company and Shoppers Drug Mart and the remainder of his career in leadership roles with leading loyalty agencies, Air Miles and Bond Brand Loyalty. Currently he is the Founder & Chief Customer Engagement Officer of Loyal Strategy Consulting, a consulting firm focused on enriching customer loyalty for leading brands. Richard can be reached at: rschenker@loyalstrategyconsulting.com or visit: https://loyalstrategyconsulting.com