By Abdul Wahab Shaikh and Shruti Lal, with Hannah Mayer and Spurthi Gummadala

Answering six specific questions holds the key to successful digital and AI transformations for CPG companies.

There’s a race on to capture value from digital and AI, and consumer packaged goods (CPG) companies are in danger of falling behind both retailers and consumers. It’s not for lack of trying. Like most sectors, CPG companies have been on some form of digital and AI transformation journey. But most of them are stuck in the pilot purgatory stage characterized by plenty of subscale activity and little at-scale value.

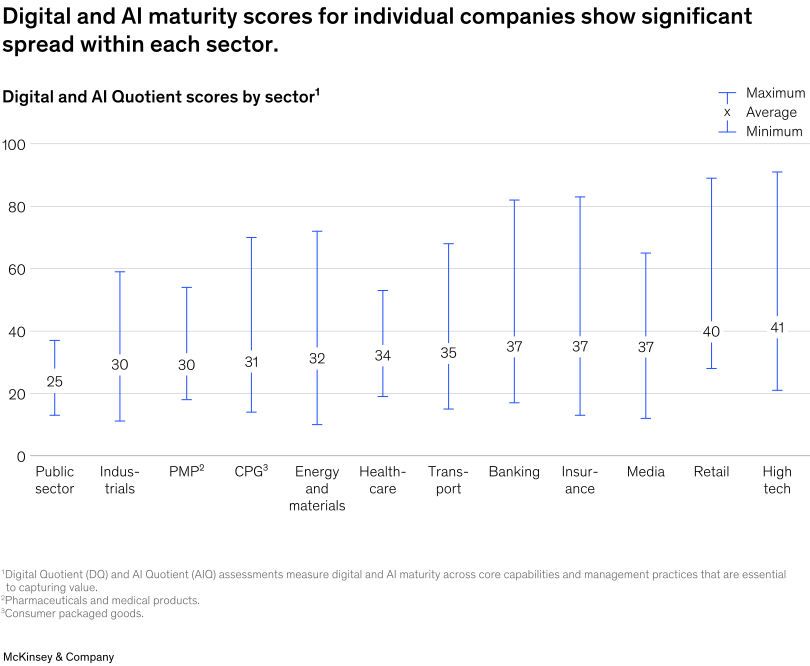

Our analysis of digital and AI maturity has shown that CPG companies are among the poorest performers, while retailers are near the top.

Exhibit 1

This halting progress is all the more frustrating and worrisome in view of the huge value at stake. We analyzed the potential of digital and AI transformations to drive top- and bottom-line impact along the full value chain. Our analysis revealed a potential 6 to 10 percent incremental revenue uplift and corresponding growth of 3 to 5 percentage points in EBITDA over three to five years, depending on the subcategory.

Furthermore, the increased adoption of generative AI (gen AI) could increase the economic impact of traditional AI by 15 to 40 percent, unlocking an additional $160USD billion to $270USD billion annually in profit (measured in EBITDA) for CPG companies globally.

The CPG sector faces some unique challenges. The proliferation of data, for example, and its complexity—sources are scattered across retailers, suppliers, manufacturers, and consumers—have created massive issues in terms of harnessing the data to find, track, and capture value. At its core, the reason for this low success rate is that companies fail to perform the deep organizational surgery required to affect the broad-based change that’s needed. It’s never “just tech” when it comes to successful digital and AI transformations. Companies need to rewire how they work.

But even while CPG as a sector performs poorly, some companies are high performers, as Exhibit 1 shows. One beverage company that embarked on a digital and AI transformation unlocked 18 percent EBITDA uplift over two years. It was able to make and sustain these improvements by being comprehensive in the scale of, and commitment to, the change needed.

A committee of senior leaders started by prioritizing domains that had significant growth opportunities and were feasible, given their capabilities. They then developed a detailed road map and established more than 50 cross-functional pods—joint teams spanning markets, regions, and enterprises—with specific goals and the autonomy to deliver necessary solutions. They put in place a centralized stage-gate process with clear decision rights to track, advance, and fund solutions to help maintain momentum.

To support the technology solutions, they moved aggressively into cloud to help create more scale and flexibility to use in building modular, customized applications. They also invested in a data lake and a governance model with clear areas of responsibility. For example, IT defined and managed the data architecture while the business defined use cases for data products. Realizing talent was an acute issue, they upskilled their own people through tailored learning curricula that included on-the-job learning, formal training sessions, and individual coaching.

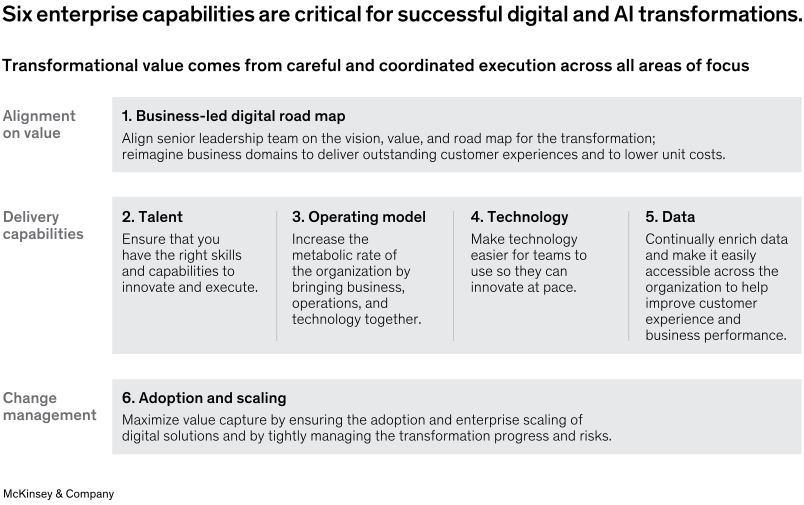

Exhibit 2

Six questions to help outcompete with digital and AI

In working with more than 200 large companies across industries, including 25 of the top 30 CPG companies, we found that six enterprise capabilities are critical for companies to rewire themselves and achieve sustainable competitive advantage from digital and AI (Exhibit 2). In rewiring how they work, CPG companies need to answer six key questions.

Six enterprise capabilities are critical for successful digital and AI transformations.

1. Where is the value?

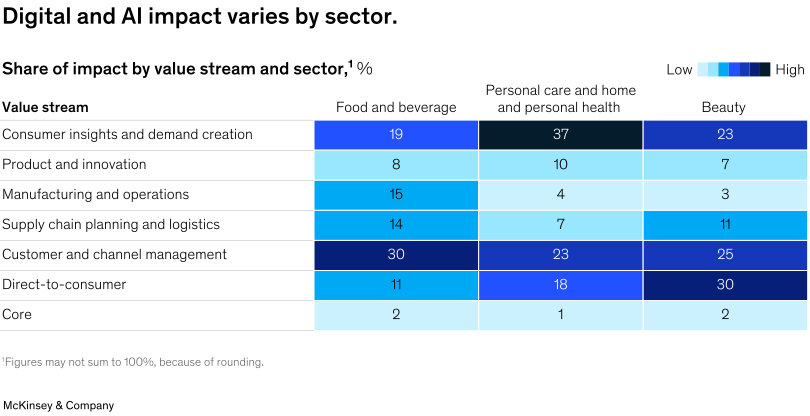

Making sure that a digital and AI transformation delivers meaningful value starts with prioritizing and focusing efforts on domains where meaningful value exists. While the distribution of value varies across CPG sectors, our analysis shows that the greatest payoff for most sectors is concentrated heavily in two areas: consumer insights and demand creation, and customer and channel management (Exhibit 3). There is one notable exception: the beauty industry, where the direct-to-consumer area takes center stage. New technologies can have a big impact on that interaction model, as well as on the e-commerce process and fulfillment management. In general, these are the domains CPG companies should prioritize for their transformation programs.

Exhibit 3

Digital and AI impact varies by sector.

As CPG companies assess the value, they will need to be thoughtful about understanding gen AI’s impact. McKinsey analysis identified just four areas—customer operations, marketing and sales, software engineering, and research and development—that could account for approximately 75 percent of the total annual value from gen AI use cases.5 The majority of that value comes from increased productivity in the form of, for example, better and faster issue resolution in customer service, more personalized communications, and more-effective product discovery. Gen AI could increase the productivity of the marketing function, with a value between 5 and 15 percent of total marketing spending.

One consumer company, for example, implemented a gen AI large language model (LLM) to improve the manual process of financial planning and analysis (FP&A) research. An initial proof of concept showed a reduction of up to 30 percent in time spent on research.

Some companies are already actively educating their organizations, especially leadership, about gen AI, the capabilities it unlocks, and its applications in business. In fact, since the second quarter of 2023, almost all CPGs we analyzed have had an immersion session on AI for C-level executives.

2. Are leaders from the business side actively part of the transformation?

CPG companies often underestimate the role of business functions in a successful digital and AI transformation, relegating the initiative to IT. Case in point: At a large food manufacturer, the supply chain domain was one of the company’s most successful domains, in part because the leadership, including the COO and CFO, made supply chain a priority. The business dedicated a senior director as product owner for not only the build but also rollout and adoption, and these business leaders joined biweekly sprint reviews, engaging with the supply chain digital leader and the working team in designing a completely new way to optimize customer service.

Top business talent should act as product owners of the transformation for their given product, working closely with technology leaders to define the road map of solutions, managing the pipeline of use cases to build the solution, influencing technology infrastructure decisions, governing data, and being the voice of the transformation to their wider teams.

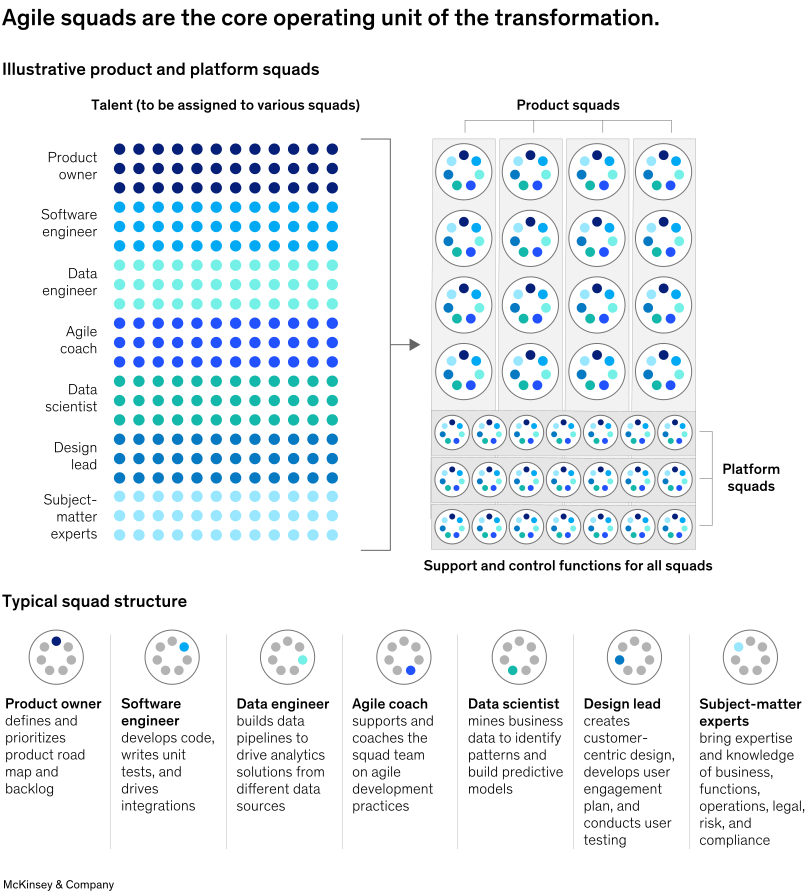

The core operational unit is the agile “squad.” Comprised generally of five to eight people across business, data, technology, and design functions, these teams are responsible for building the solutions on the road map (Exhibit 4). They are crucial for scaling. Acting autonomously based on clear guidelines, these agile squads are the only way companies can enable hundreds or even thousands of teams to deliver transformational change.

Exhibit 4

3. Are you an attractive long-term employer for digital talent?

Without top in-house technical talent, CPG companies will struggle with their transformation. Having a hiring strategy and competitive compensation will only get you so far in attracting and retaining digital talent, especially when you are competing with digital natives. The core issue is that work at CPG companies often doesn’t attract top tech talent. Companies will need to offer meaningful missions, learning opportunities, and an environment where tech talent can thrive.

A good place to start is upskilling leaders to better understand how tech creates value. P&G instituted a reverse-mentoring program in which junior tech people worked with senior leaders to help them understand how to use tech. Leaders also went to leading digital businesses to observe operations and speak with leaders to understand what skills are important to bring into an organization.

It’s important to focus on hiring talent with some proficiency in relevant areas. Competent developers are significantly more productive than inexperienced ones, and that trend carries over into gen AI as well.8 To find the right talent, CPGs should look to suppliers or retailers who are already progressing on their digital journey. Adjacent sectors such as hospitality and telecom can also be sources of expert talent with broader skills that are transferable to CPG companies. Offering promotions and compensation based on skills mastery and establishing engineering-specific career tracks can also help in retaining your top people.

A large beverage CPG knew it needed to upgrade its talent if it wanted its digital and AI transformation to succeed. But established recruiting practices were slow and not geared to the leading technical talent the business needed. A talent win room came together with a new plan. First, they invested in developing clear new role descriptions, tailored to the specific skills required. Second, they focused on identifying new recruiting sources rather than turning to more general jobs and networking venues. Third, they sped up the evaluation process with coding tests, which allowed them to quickly narrow down more than 7,500 initial applicants to high-potential candidates. And fourth, they put in place batch days organized around the full set of decision makers, which allowed them to make decisions on candidates and extend an offer within 24 hours. Over this time, the talent win room had a set of KPIs that they referred to often to track their progress and correct any issues quickly. In 90 days, they were able to fill the 25 critical digital and analytics roles they needed—a tenfold increase in the speed of hiring.

4. Are you deploying your technology investments to optimize for reuse?

Many CPG companies have key elements of a core infrastructure in place—such as cloud, data lakes, and planning software—but they are often not set up to operate at scale. This situation is largely the result of a complex tech stack where systems are built to support a specific function or market. This makes it challenging to share data and reuse solutions, leading to costly replication of applications and difficulty in scaling.

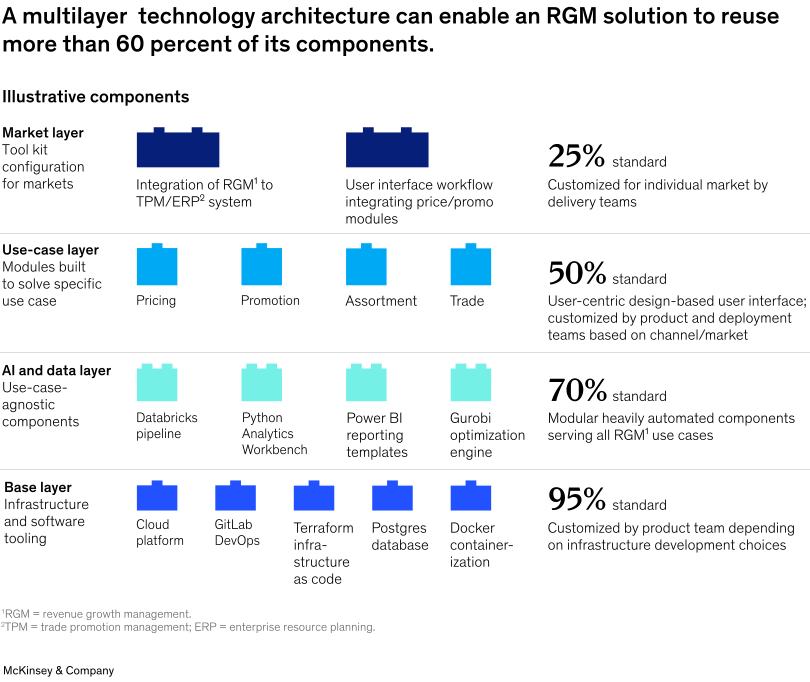

Enabling solutions that serve multiple domains has significant benefits, such as allowing a company to use a broader range of data to make better revenue growth management (RGM) decisions. Getting to this state requires companies to develop a modular architecture (Exhibit 5).

Exhibit 5

For this approach to work in practice, companies need a global strategy and a team made up of experts from central IT (including enterprise architects, cloud developers, and engineers) and leaders from target markets to design the system together. They should focus on creating modules to support three to five market archetypes (for example, hypermarkets in the United States and more-traditional trade stores in Latin America), develop a road map for building them, and then test them in the market. Typically, this process includes making key decisions, such as what domain tools to deploy, what cloud infrastructure to develop, and whether to build or buy specific technologies.

5. Are you developing data products?

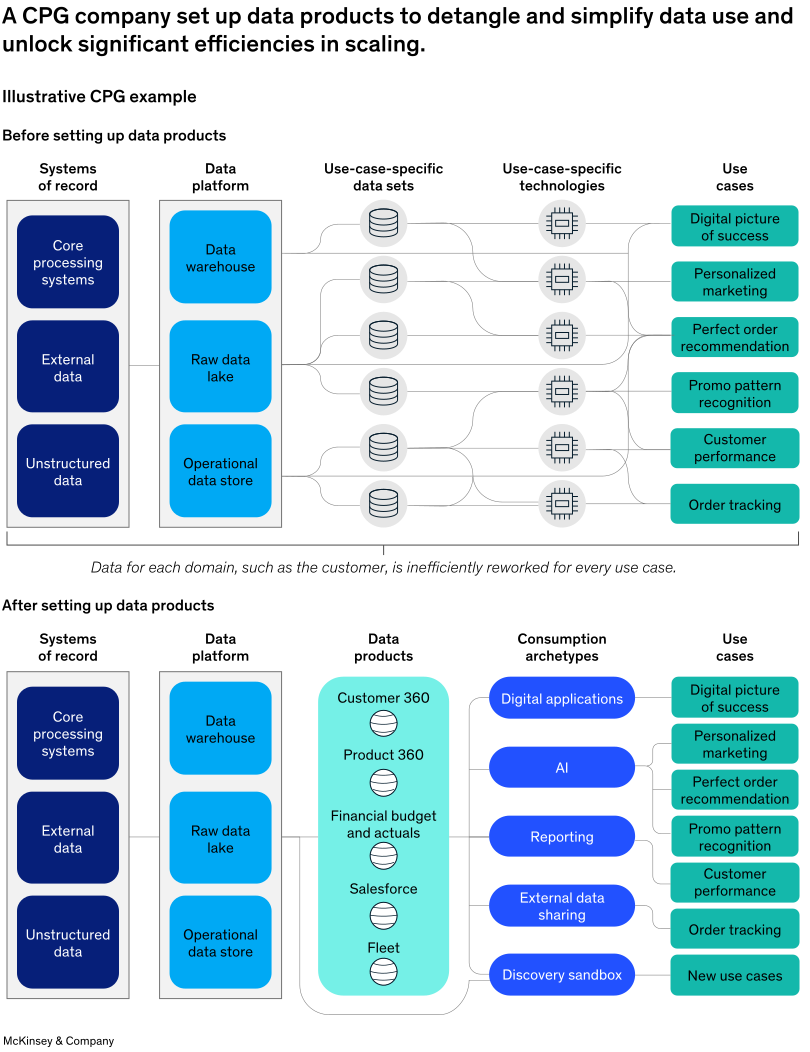

Data in the CPG industry is notoriously fragmented across retailers, distributors, consumers, syndicated data providers, marketing platforms, contract manufacturers, third-party logistics providers, and more. This issue has become even more acute with generative AI, with the introduction of huge amounts of unstructured data. Without a centralized, well-coordinated data strategy, teams end up using raw data for their one-off needs, wasting data scientist and engineering capacity on creating inconsistent data sets that can’t be accessed by other teams or systems.

To redress this issue, companies need to focus on three things:

Build data products. Data products are reusable building blocks of data that can be easily consumed by teams and systems. One CPG focused on developing a data product on store-level customer attributes, which teams across sales, RGM, planning, and supply chain used for their own use cases. To get this right, the company had to understand what data it had and which parts of it were important to each function’s use cases. Out-of-stock data, for example, was important for sales and planning functions, while the promotions calendar, promotions ROI, and volume uplift data were important for RGM (Exhibit 6).

Exhibit 6

Standardize APIs and invest in data pipelines. It’s important to create standard APIs and systems (with the right access privileges) that developers can use to access data sources. Invest in data pipelines to deliver data to the right data products. Because the company often doesn’t own all the data from retailers or manufacturers, for example, that data needs to be constantly monitored for changes.

Put in place a strong data product owner. The dedicated data product owner should be from the business, not the IT, side of the company. One of the key roles of the data product owner is to establish and closely monitor meaningful KPIs to track the most important determinants of value to the business, such as fulfillment, on-time delivery to warehouses or shelves, or data-product usage rates.

A global CPG was able to rapidly transform its RGM domain end-to-end in just two years by building modular technology components that enabled it to scale solutions across its more than 30 category/market combinations. Instead of building pricing and promotions analytics around the data available for a particular region/category, for example, the company built a standardized RGM data product that teams could easily use. Each market category only had to input its own data into the product to take advantage of the underlying analytics engine. Because the data product was modular, specific local factors, such as currencies and units of measure, could easily be swapped in.

6. Are you anticipating and preparing for the most critical scaling challenges?

The fragmentation in CPG companies—accounts, categories, brands, geographies, and functions—makes adoption and scaling technology challenging. Too often, companies have to redo a lot of work to tailor solutions to local environments.

While the adoption of technology relies on many factors, in practice it is most crucial to involve potential future users early in solutions development; give end users incentives to use the technology; minimize the effort required of them, by building solutions into existing tools, for example; and track their uptake over time.

The key to tackling scaling is to “assetize” solutions by packaging them as modular assets that teams can easily reuse. The focus should be on technologies, such as APIs; processes, such as solution rollouts, operational guidelines, and training; and support, such as subject-matter experts who understand how to deploy the solution and adapt it to different environments.

A digital and AI transformation is a complex journey. But for CPG companies willing to make the commitment to change at scale, the value can be transformative and a competitive necessity.

About QuantumBlack, AI by McKinsey

QuantumBlack, McKinsey’s AI arm, helps companies transform using the power of technology, technical expertise, and industry experts. With thousands of practitioners at QuantumBlack (data engineers, data scientists, product managers, designers, and software engineers) and McKinsey (industry and domain experts), we are working to solve the world’s most important AI challenges. QuantumBlack Labs is our center of technology development and client innovation, which has been driving cutting-edge advancements and developments in AI through locations across the globe.

Abdul Wahab Shaikh is a partner in McKinsey’s Atlanta office, Shruti Lal is a partner in the Chicago office, Hannah Mayer is an associate partner in the Bay Area office, and Spurthi Gummadala is a consultant in the Seattle office. The authors wish to thank Roger Roberts for his contributions to this article. This article was edited by Barr Seitz, an editorial director in the New York office.