By Lidiya Chapple, Clay Cowan, Ellen Scully, and Jillian Tellez Holub

Travel Invented loyalty as we know it. Now it’s time for reinvention. Members of travel brands’ loyalty programs have become increasingly disloyal. The question seeking answers is “What will bring these straying customers back? Travel brands didn’t invent loyalty programs, which have been traced to as far back as the 18th century. But ever since the first major airline frequent flier programs appeared in the early 1980s — soon to be followed by similar programs from hotel chains — the travel industry has become known for letting customers accumulate redeemable “miles” and “points.” Modern-day voyagers are deeply familiar with loyalty-related concepts such as status tiers, members-only lounges, and point-earning credit cards.

Travel loyalty programs were originally designed to influence travelers’ behavior. By offering rewards such as free flights and hotel rooms to frequent customers, a company might convince power users to consolidate their travel spending with its brand. Why fly airline X when you’re halfway to earning a free perk for remaining faithful to airline Y?

Over time, many travel loyalty programs became wildly successful — not just as a way to boost sales or strengthen customer relationships but as major profit centers in their own right. Travel companies found they could sell loyalty points in bulk to, for instance, banks, which in turn offered the points to their credit card customers as rewards for spending. In 2019, United’s MileagePlus loyalty program sold $3.8 billion worth of miles to third parties, which accounted for 12 percent of the airline’s total revenue for that year. In 2022, American Airlines’ loyalty program brought in $3.1 billion in revenue, and Marriott’s brought in $2.7 billion.3 Many loyalty programs have evolved into discrete divisions with their own profit-and-loss ledgers.

Along the way, however, some travel players have shifted their focus away from the original purpose of these programs. As loyalty programs have become powerful bottom-line enhancers, companies have sometimes been tempted to view them first and foremost as revenue generators instead of tools to sway customers’ behavior or to improve customers’ experiences. The post-pandemic resurgence of travel demand has also pressured companies to shore up their loyalty programs’ viability by devaluing members’ points and miles and enacting rule changes that have at times caused customer frustration. At the same time, innovative loyalty programs in other industries are raising the bar, opening customers’ eyes to the value that loyalty programs can offer.

As a result of these factors, travel loyalty program members have become increasingly disloyal. For some customers, reaching the top tier of a loyalty program is still almost a facet of their personal identities — Just a couple of more flights, and I’ll reach elite status! But many loyalty program members now seem more inclined to play the field. The warm feelings at the heart of loyalty, which lead travelers to show allegiance to a brand and trust that their faithful behavior will be noticed, seem to fade when brands let their focus drift away from rewarding their most valuable and consistent customers.

Loyalty is about more than a program, a department, or a tangible redemption offer.

Loyalty is about more than a program, a department, or a tangible redemption offer. True loyalty is won through a genuine desire to forge bonds with customers and thereby maximize each customer’s lifetime value to the brand. Travel brands, therefore, should consider rethinking and reinventing their loyalty programs in ways that frame loyalty as something more than points and miles. A mindset shift, coupled with three practical actions, could help restore the luster of loyalty programs while bringing straying customers back into the fold.

A mindset shift, coupled with three actions, could restore the luster of loyalty programs while bringing customers back into the fold.

How we got here: Disruption, devaluation, and dissatisfaction

When travel came to a halt as a result of the COVID-19 pandemic, many travel brands — hoping to keep customers happy — “froze” the loyalty program status levels of members who might have otherwise lost perks due to a lack of travel activity. When travel spending was slow to resume, brands changed their program rules to make status tiers significantly easier to reach and maintain. These moves made sense in the face of an unprecedented disruption, with far fewer miles and points being redeemed.

But as travel recovered, loyalty programs became burdened by increased redemptions and overpopulated high-status tiers (evidenced, for example, by the lines outside the doors of airport lounges). Some major travel brands have responded by adjusting loyalty program rules. They’ve ended the status extensions that were granted during the pandemic, and they’ve devalued points and miles — raising the bar to redeem them for free flights and rooms.

All these changes have, understandably, been made with an eye toward programs’ profit-and-loss statements. But collectively, they’ve resulted in widespread customer dissatisfaction. Program members have chafed at having their points devalued and benefits clawed back. Meanwhile, successful loyalty programs in other sectors have opened customers’ eyes to other types of value that these programs can provide, such as better customer experiences, richer communities, more tailored personalization, and exclusive access to events or offers.

EXHIBIT 1

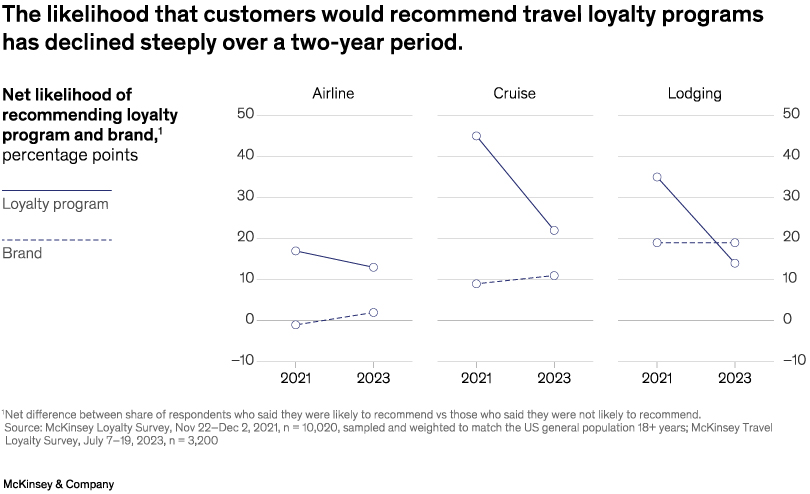

Loyalty surveys conducted by McKinsey in 20214 and 20235 revealed a steep decline in the likelihood that a customer would recommend airline, hotel, and cruise line loyalty programs to a friend or colleague—even though the likelihood that customers would recommend the airline, hotel, and cruise line brands remained relatively steady (Exhibit 1).

The likelihood that customers would recommend travel loyalty programs has declined steeply over a two-year period.

A focus on a loyalty program’s bottom line can distract from its higher purpose

A travel loyalty program might be able — at least temporarily — to disappoint its members while inflicting minimal damage on its company’s earnings. This is because so much of a modern travel loyalty program’s importance comes from B2B sales of batched points or miles. The programs’ most relevant customers in terms of generating revenue are credit card companies, not individual travelers. And these B2B deals generally involve long-term contracts that guarantee sales years in advance. A travel brand can unilaterally issue more loyalty program points to sell to third parties at any time, as well as raise the redemption levels for flights or rooms if margins become undesirable.

Meanwhile, airline travelers have fewer options than they did in the past. Consolidation of major airline brands means it’s harder for frequent fliers to abandon one airline and its loyalty program for another without losing access to convenient flight routes or departure times. And customers who have already banked a large number of miles or points with one airline or hotel program can feel locked in.

For all these reasons, loyalty programs appear to be in a position of strength. But a narrowed emphasis on revenue and costs could lead to brands’ losing focus of the big picture. Travel loyalty programs were originally conceived as a clever way to influence customer behavior — and encourage customer loyalty. But it’s not clear if the programs are currently fulfilling either mandate as successfully as they could.

EXHIBIT 2

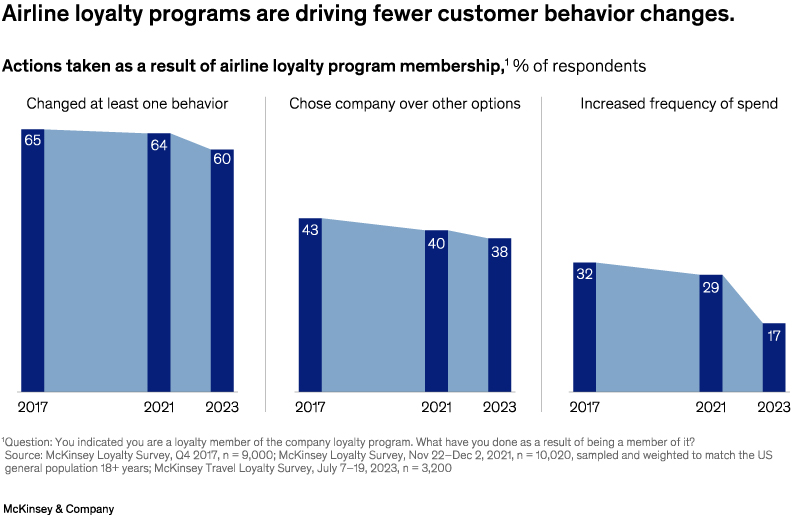

McKinsey research reveals that airline loyalty programs’ ability to change fliers’ behavior declined between 2017 and 2021, and again between 2021 and 2023 (Exhibit 2). During those time frames, it became less likely that a customer who was a member of a given airline loyalty program would report that they chose the associated airline over other options or increased the frequency of their spending with that airline. If this trend continues, it could eventually create a vicious cycle: airlines would cut loyalty program budgets if they deemed them ineffective at influencing customer behavior, lower budgets would lead to reduced program benefits, and less attractive benefits would result in customers perceiving program participation as having less value.

Airline loyalty programs are driving fewer customer behavior changes.

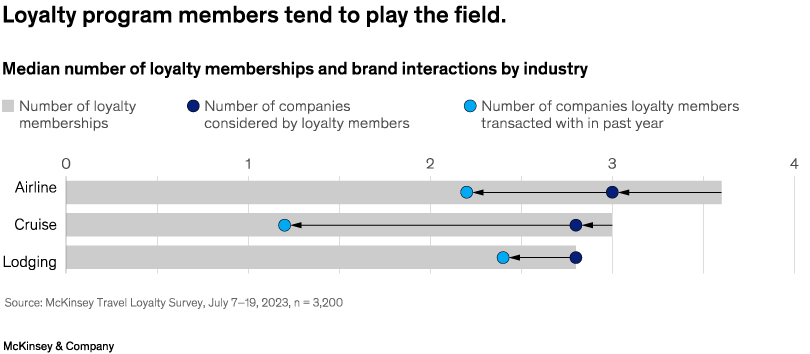

McKinsey research further shows that loyalty program members these days aren’t especially loyal (Exhibit 3). Hotel, cruise, and airline travelers are typically members of about three or four different loyalty programs within a given sector, our analysis finds. On a yearly basis, they consider traveling with about three different brands within that sector and ultimately transact with more than one of them. Travelers don’t even consolidate their spending with the brand they say they “prefer” within a sector: the median share of the customer’s wallet for preferred brands is only about 50 percent in lodging, 60 percent in cruise lines, and 60 percent in airlines—with the remainder of the customer’s spending spread around to other players within the same sector.

EXHIBIT 3

Loyalty program members tend to play the field.

Evidence suggests this trend will persist. According to our 2023 survey on travel loyalty, younger generations are more likely to consider and transact with multiple travel players. Gen Zers and millennials consider about 1.7 times as many brands as do baby boomers and the Silent Generation and transact with about 1.3 times as many brands.

All this comes at a time when the travel loyalty market is becoming more competitive. Consumer banks, which were once content to offer cobranded credit cards featuring travel brands as the marquee partner, are now launching their own self-branded travel awards ecosystems and booking platforms. Travelers might wonder why they should put all their loyalty points in one basket with a single airline or hotel brand when a consumer bank might offer more flexible rewards redemption and possibly a better user experience. (It’s worth noting that our research suggests the likelihood that a customer would recommend some of the major consumer banks with travel loyalty initiatives to a friend or colleague is far higher than the likelihood that a customer would recommend a cruise line, lodging brand, or airline.)

How to reshape loyalty for a new travel landscape

Our research finds that experience — far more than tangible, “earn and burn” benefits — is what wins customers’ loyalty. Experiential factors, including “offering an experience worth paying more for” and “feeling taken care of,” have become more important over time and now account for three of the top five (out of more than 40) drivers of loyalty to cruise lines, hotels, and airlines. For hotels, experience has four times more impact than tangible benefits on purchase frequency, while for airlines, experience is more than twice as likely to influence frequency. Positive past experiences are the biggest factor in customers’ desire to travel more with a company in the future.

The following three steps could help travel brands adjust to this changing landscape and engender loyalty that goes beyond a mere quest for redemptions and perks.

Put experience at the core of loyalty programs

When our 2023 survey asked American respondents which company they’re most loyal to, Amazon received more votes than the top six travel players combined — despite the absence of any traditional, points-based loyalty program. How does Amazon win loyalty? By providing a frictionless experience.

How can travel brands learn from this and win customers’ love even when points and miles are worth less? By offering distinctive, satisfying experiences: making customers feel delighted is the key to their hearts, but McKinsey’s 2023 loyalty survey showed that only 20 percent of travelers were delighted by a recent travel experience.

Companies should strive to design loyalty programs around experiential benefits that make travelers feel special. This can be win–win, such as when Delta offered free in-flight Wi-Fi to loyalty members, which led to a better experience for the members while also boosting enrollment in Delta’s loyalty program. In retail, some programs bring together engaged communities of like-minded brand loyalists. Advance notice or exclusive access to offers can send loyalty members a signal that the brand considers them VIPs.

Brands should seamlessly integrate customer experiences between desktop, mobile, and physical locations — meaning that frontline workers have an important role to play. Proper execution of customer service is vital for getting experiences right, so companies should try to keep frontline workers top of mind. Workers should be given the proper training and tools to satisfy customers, and the effectiveness of this training should be measured.

When it comes to mitigating, or avoiding, a negative customer experience, saying “sorry” can go a very long way. Companies should proactively engage customers after service shortfalls, as a service challenge can actually lead to an increase in customer satisfaction if handled well. The form an apology takes might be made commensurate with a customer’s status level in the brand’s loyalty program, and any recompense can be informed by a predictive analysis of its impact—considering factors such as the magnitude of the lapse and the nature of the customer’s other recent interactions with the brand.

(Finally) use data to offer personalization to members

Travel brands have long had access to reams of customer data. Loyalty program members surf on travel companies’ Wi-Fi, sleep in their hotel rooms, fly on their planes, and cruise on their ships. But many travel brands haven’t yet captured the opportunity to use these unique data to offer their members personalization on par with other industries. Likewise, although airlines and hotels have incredibly sophisticated, lightning fast, AI-enabled pricing algorithms, they aren’t consistently harnessing their technology capabilities to power real-time customer personalization.

Nontransactional engagement opportunities, such as the daily interactions fostered by social communities, offer rich troves of data that can be used to hone personalization. In turn, personalization can drive engagement, as seen in Sephora’s Pocket Contour Class initiative, which lets users upload a selfie to get personalized makeup tips.

Personalization can be employed to tailor both experiences and offers for loyalty members. Our research has shown that 78 percent of consumers are more likely to make a repeat purchase when offered a personalized experience. The goal should be to achieve a hypersegmentation of program members that’s so nuanced, it results in a “segment of one.”

Rethink partnerships to protect self-interests while delivering customer value

Since the 1980s, travel companies have been partnering with banks to launch cobranded credit cards. But several credit card brands now offer their own, self-branded travel rewards ecosystems. These ecosystems sometimes direct bookings to airlines, hotels, and cruise lines — but they can also serve as a way for credit card brands to steal away travelers’ loyalties. These types of transactional partnerships with consumer banks might eventually cease to be a winning play for travel companies. In time, travel loyalty programs could be driven to seek alternate sources of funding.

The best kinds of partnerships build richer connections with consumers while boosting engagement through thoughtful collaborations. Uber’s partnership with Marriott gives users the option to link the brands’ loyalty programs, tapping into two large customer bases and providing more convenient travel experiences.

One promising recent example of collaboration is a travel media network. A hotel company might, for instance, launch a media network that allows third-party brands to place relevant, nonintrusive, personalized advertisements in the hotelier’s owned spaces — websites, hotel lobbies, guest room TVs, and so forth. This type of partnership can offer travelers an elegant, curated experience while providing the travel brand with an alternate monetization route.

In general, travel companies should cultivate collaborations that protect their interests, generate new revenue streams, add personalization and value for loyal customers, and diversify touchpoints with those customers. Early action could prove vital here, as the travel space will not accommodate infinite partner ecosystems.

As other industries raise the bar and consumers grow increasingly dissatisfied with travel loyalty programs as they are designed today, travel industry leaders may need to ask themselves some hard questions. How can points and miles be paired with experiences and excitement? Which partners are truly adding value? What is causing customers to stray, and how can their loyalties be won back?

Travel brands were loyalty innovators. But travel loyalty programs might soon hit an inflection point. Now is the time to innovate and win back customers’ allegiances.

Lidiya Chapple is an associate partner in McKinsey’s Atlanta office, where Jillian Tellez Holub is a partner; Clay Cowan is a partner in the Dallas office; and Ellen Scully is a consultant in the Seattle office.

The authors wish to thank Bella Alfaro, Alex Cosmas, Marilyne Crépeau, Oren Eizenman, Austin Hack, Ryan Mann, Jacob Miller, Afiya Romeo, Matthew Straus, and Jamie Wilkie for their contributions to this article.