By Stephen Hogg

For small business owners, today’s business is anything but usual. Markets, consumers, and realities are ever-changing, meaning that small business owners have to react quickly, sometimes changing their business models at the core. And those reactions come with a cost. Inflation, the rising cost of goods and PPE (personal protective equipment) purchases represent the largest challenges facing small business owners’ bottom lines today. As they navigate this changing world, many are seeking solutions for agility and resilience powered by technology.

Open banking represents one such opportunity space. It is a huge paradigm shift for small business owners, empowering them to be smarter both when making business decisions and when managing their finances. Rather than going it alone, small business owners view open banking as an opportunity for partnership in their ventures as they continue to grow.

With growth comes new challenges for small business owners; almost all of them digital. A successful business now represents a cybersecurity target, an overwhelming amount of data with little knowledge of how to protect it and more inventory to manage. For small business owners, digital problems call for digital solutions, especially when it comes to protecting their business. The buzz around the proverbial, digital water cooler is about finding solutions, and small business owners are all ears right now.

Today represents a unique time for small business owners with a society still unsure of “normal.” However, rising costs and cybersecurity threats are here to stay. As small business owners look toward the future, their path forward is open to partners that can help with obvious hurdles and pragmatic solutions.

Navigating cost uncertainty

Small business owners are getting used to a new paradigm where business is anything but usual. Most have had to significantly pivot their businesses in some way or another–and those shifts come with costs. Whether it’s the rising cost of goods, the infrastructure needed to implement new business models or simply purchasing mass quantities of PPE, small business owners across all industries and geographies are feeling the squeeze.

Inflation is their number one pain point, especially for those who work in high-volume, consumer-facing industries like restaurants and retail. Customer acquisition is also a pain point, especially for those who work in professional services. On the other hand, talent acquisition stands out as a challenge for sectors like medicine and agriculture.

Funding is an ongoing issue as a majority of small business owners have received a business loan (62 percent) and are looking for faster and easier access to capital for their business (85 percent).

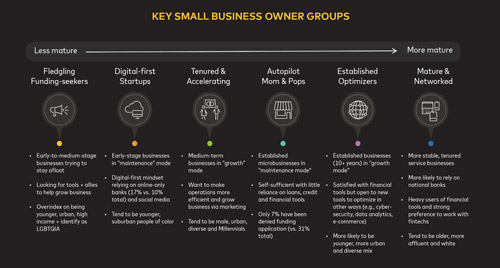

All small business owners face common challenges, but our research revealed unique needs and mindsets across six key groups. Based on a variety of factors ranging from tenure to industry to company size, the data shows that reliance on technology and need for funding are core defining factors as one way to group small business owners.

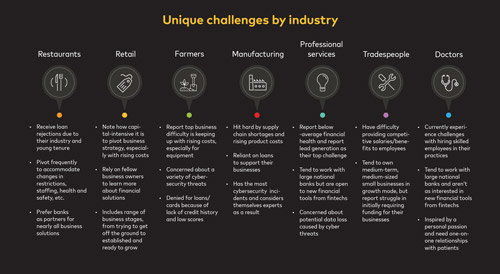

In addition to mindset, industry is a strong indicator of unique small business owner needs. While restaurant owners cite business tenure as a primary reason for loan rejection, retailers are facing capital-intensive pivots and rising cybersecurity threats, creating greater funding need. Rising costs especially plague farmers, manufacturers and those in professional services who are reliant on networking and struggle with customer acquisition with less face-to-face time available.

COURTESY MASTERCARD | NAM RESEARCH & INSIGHTS

Challenges vary by industry

Despite these challenges, small business owners remain optimistic and ready to grow. Nearly half (47 percent) say they are in growth mode with the remainder (42 percent) indicating they are in maintenance mode.

As small business owners scale, there are clear opportunities to become a partner for them with customized, agile funding solutions. More than 8 in 10 small business owners told us they are looking for “faster and easier access to capital” (85 percent) and “loans that are tailored to their business’ specific needs” (81 percent).

Whether it’s with low interest loans, credit card options or micro-loans that allow them to adjust or expand their business, small business owners are hungry for solutions to navigate a shifting landscape. In fact, demand for such solutions has never been higher.

COURTESY MASTERCARD | NAM RESEARCH & INSIGHTS

SME seeking allies to drive growth

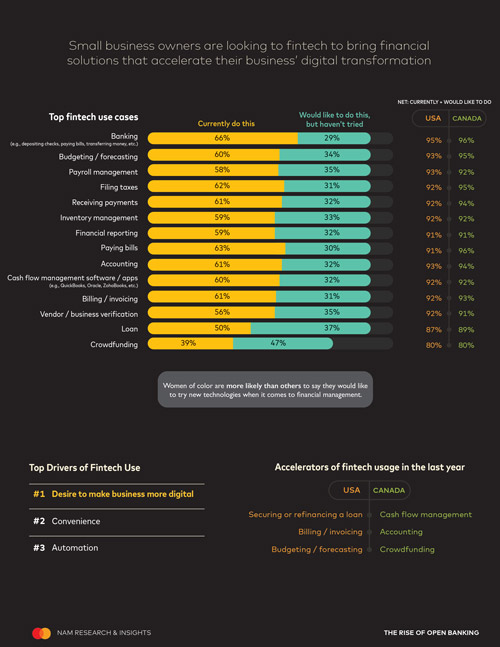

From e-commerce to remote team meetings, the pandemic has created a new army of digital experts when it comes to business operations. For many small business owners, this time has raised their financial IQ as 95 percent consider themselves heavy FinTech users for both business and personal needs.

Small business owners now rely on technology for a variety of tasks to keep their businesses on track. Everyday tasks like banking, payments and budgeting are already taking place on digital platforms with interest in expanding to more sophisticated applications like loans and crowdfunding. The growing use of FinTech among small business owners is now giving rise to a new generation of business owners who are more inclined to embrace open banking for business.

Similar to FinTech overall, open banking is making headway across a variety of financial needs, with more than 7 in 10 small business owners linking financial accounts for banking, invoicing, paying bills, accounting and receiving payments.

Small business owners are embracing open banking as a member of their team, with many viewing this linkage as a way to build strategic advantage. Eighty-five percent are looking for customized financial recommendations for their business from the use of their data. The data also shows that the number one reason they lean into open banking is to improve their decision-making process, followed by saving time and effort.

This adoption goes beyond their business operations; many are leveraging open banking for their customers as well. Payments are a driving use case as nearly 9 in 10 accept some form of digital payment from their customers, and a similar percentage use open banking-backed methods to accept payments.

The top benefit of offering open banking for customers is the ability to accept payment more quickly. In addition to speeding up cash flow, small business owners lean into open banking to verify, secure and personalize transactions while meeting customer expectations in today’s digital world.

COURTESY MASTERCARD | NAM RESEARCH & INSIGHTS

Overall, open banking is seen as a driver of intelligence, insights and convenience for small business owners looking for a streamlined way to tackle critical business tasks.

Despite rising FinTech use, 94 percent of small business owners still encounter financial pain points and stress. Many report that access to capital, financial management and rising costs are stressful aspects of running a small business.

Small business owners are seeking allies that can help them with financial management to address these pain points. Majorities are looking for better ways to harness their business’ data to get a holistic view, optimize financial management and inform business strategy.

They are open to receiving help as the majority say they trust others to help with financial planning for their business (63 percent) and are looking for custom recommendations for how to optimize financial management based on their business’ data (85 percent).

Unleash the power of data to drive innovation

Open banking is a platform for innovators to develop new and improved financial services and to deliver valuable intelligence and customized insights for small business owners. It puts small business owners in control and allows them to benefit from their financial data in order to tackle critical business tasks.

Addressing key pain points, like access to capital

Small business owners are looking for financial solutions customized to their needs and to ease the financial pain points of operating a small business. With this data, lenders can get a better picture of the small business in order to make better credit decisions through Mastercard’s open banking platform.

Innovative FinTech solutions are being embraced by small businesses. The growing use of FinTech among small business owners is now giving rise to a new generation who are more inclined to share their data through open banking. More than 9 in 10 are heavy users of FinTech for both personal and business finances.

Account-based payments are an emerging area

Open banking technology offers more ways to pay with greater speed, convenience and confidence. With better quality data and insights about the small business, the non-card payments journey can be smoother.

There is an opportunity to connect with small business owners over tools that protect and support their businesses more broadly beyond financial needs. Our research shows that the top areas where small business owners are open to exploring new options are cybersecurity, data analytics and inventory management. Digital security is particularly top-of-mind, as two-thirds of small business owners have experienced at least one threat, with phishing and malware being the most common.

Nearly three-quarters (74 percent) currently have digital security solutions implemented, but many are deploying only basic solutions like antivirus software and firewalls. Expertise also appears to be reactive, as those who have experienced a threat express both greater prioritization and greater expertise when it comes to digital security.

Digital security is on the radar, but still surface-level

Small business owners are interested in exploring new options for security, but most don’t know what they don’t know. There is an opportunity to help them become more proactive experts with knowledge and education. This can help them discover blind spots and become more informed on niche topics. Small business owners are seeking not only the functional benefits of protection, but also the emotional peace of mind and fulfillment that comes from checking the box on security diligence. Lean into solutions that clearly deliver these benefits to onboard new customers, build trust and grow the relationship long-term.

This group is seeking more holistic tools, such as subscriptions and bundles that can streamline the process. One trusted source of information is other small business owners and organizations, indicating there is an opportunity to socialize security solutions through those channels.

Small Business Research Methodology: This research is from a series of 3 quantitative surveys conducted online in the U.S. and Canada by The Harris Poll on behalf of Mastercard among over 3500 US and Canadian citizens ages 18 and older. All participants were screened for Small Business ownership, general credit card use, card use for business expenses, been in business 1+ years and make between $50K -$20MM per year in revenue with readable sample by gender, generation, affluence, ethnicity, card ownership, major bank relationships, and region.