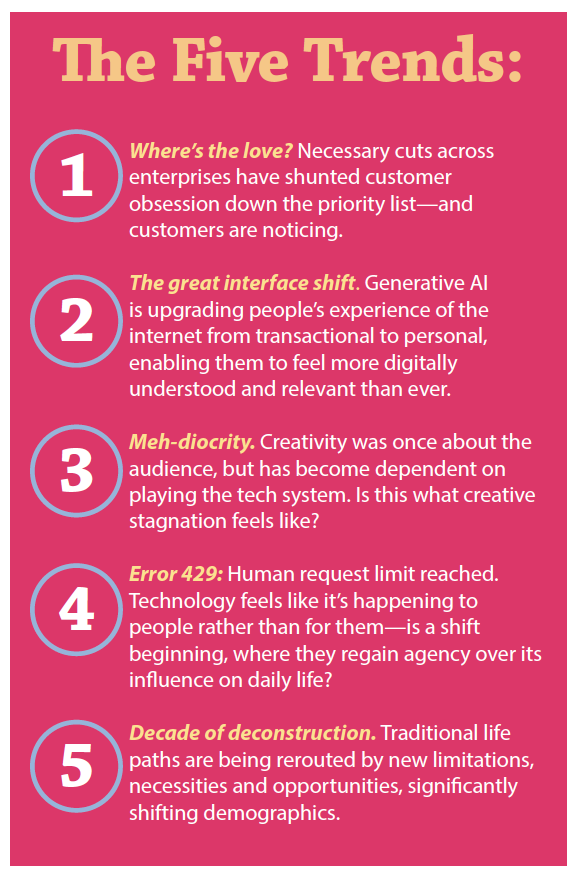

The visible and invisible mediators between people and their world are changing. There are various layers that mediate between people and the way they live their lives, influencing what they think, how they interact, and how they feel within the world around them. Whether driving consumption, maintaining authority, progressing culture, or sharing information, organizations are part of a matrix of intermediaries on which economies are built. There’s undeniable fragility in the relationships between people and these influences because they’re changing. Some are emerging, some declining, some adapting—and all hold significance to people’s lives. This is putting society into a state of flux, where people are now deconstructing everything as they try to figure out who they are in the world. And that goes into the heart of Accenture’s Life Trends this year.

There’s always something sitting between people and the world around them. Whether it’s a tool, a story, a brand, or a person, external factors influence what they think, how they interact, and the way they feel as they move through life.

These trends explore the evolution of these factors—because it’s putting society into a state of flux. People are now deconstructing everything as they try to figure out who they are in the world.

New intelligence layers are emerging in digital interactions, while people are examining the consequences of past experiences. The harmony between people, technology and business is showing tensions.

Accenture Life Trends identify and explore the various factors we expect will change the way people experience and interact with brands, organizations, governments and systems in the coming year and beyond. For this article and excerpt, we’re going to take a look at just one of the trends identified in the Report, which we recommend downloading and reading in full.

Where’s the love?

Necessary cuts across enterprises have shunted customer obsession down the priority list—and customers are noticing. For years, the correlation between customer experience and revenue growth inspired organizations to hold the customer at the center of every decision.

Now, economic considerations are forcing cuts throughout enterprises, driving friction between customers and brands across channels—in the form of price increases, quality cuts, illogical subscriptions, and poor customer service. Customers are noticing, and some feel hard done by.

The key question: How do brands keep their product in the basket in the long term?

* Source: Accenture Life Trends survey, August 2023

** Source: Accenture CxO Pulse survey, June 2023

What’s going on?

Businesses are scrambling to cut costs and protect profits against a strained economic backdrop. They’ve made tough decisions to survive, with one major consequence: the erosion of customer experiences. Like it or loathe it, consumerism is a socio-economic fact of life for billions of people, with much of their day-to-day experience influenced or mediated by consumer culture. The changes described in this trend are having a significant impact across multiple aspects of life, affecting how people feel every day.

Until recently, the direct link between profit and customer experience made the latter top priority, often at the expense of other factors.

Widespread digital adoption in the 1990s—particularly the internet and, later, smartphones—pushed focus onto experience, which hadn’t previously been emphasized by many businesses outside hospitality. Screen-driven interaction expanded design’s scope beyond physical and graphic design to include usability and desirability.

Decade of deconstruction of CXOs say they plan to raise prices to pass cost increases to customers. Forty percent of people worldwide think that many companies are prioritizing higher profits over better customer experience.

Pine and Gilmore’s seminal 1999 book, The Experience Economy, brilliantly captured this shift. Designers realized that a user-focused approach yielded the best results, and people began comparing everything to their best digital experiences, fueling liquid expectations. Without profitability, organizations won’t survive long. As the economic climate sharpens investors’ focus, leaders are seeking ways to reduce expenses and increase operating margins across their business. People feel the impact in multiple aspects of daily life, with many micro-disappointments adding up to a big dent in their lived experience. It seems the promises of value, choice, ease and empowerment are being downgraded, and it stings.

For over a decade, brands seemed obsessed with their relationship with customers, flooding social media with relatable content in a tone of voice that drew people in. With unfathomably quick delivery, delightful personalization and customizable subscriptions, brands raised expectations to levels that were costly to maintain.

From there, customers came to expect brand relationships that far exceeded the transactional. That hasn’t changed, but the reality of what brands now offer is feeding a tension that shouldn’t be ignored and is manifesting in a few ways.

There’s evidence of brands deprioritizing customer experience, with some companies cutting quality or quantity but maintaining prices. Some people understand—others find it dishonest.

Leading reasons why customers feel less valued: 47 percent poor customer service; 41 percent ignored feedback; 37 percent declining product quality; and 25 percent worsening packaging.

“Shrinkflation” describes a reduction in the quantity or size of a product, while retaining its price. An example is charging as much or more for a chocolate bar that looks the same but weighs less. This trade-off forces consumers to pay increasing prices for diminishing returns. While this isn’t a new practice, the cost-of-living squeeze heightens consumers’ attention to value—and they can easily shout about it to alert others. Reddit community, r/shrinkflation, documents changes in sizing and quantity of products, and compares to the original.

A newer practice has been labeled “Skimpflation” by National Public Radio’s Planet Money in November 2021, describing a decline in the quality of service throughout the global economy, among travel companies, retailers and restaurateurs.8,9 It might mean swapping quality ingredients for cheaper alternatives, or compromising on quality-assuring manufacturing processes to save time and money.

As people’s wages aren’t rising in line with inflation, the drop in value for their purchase hits hard.

It’s not just sizing and quality—it’s also surge pricing in places like restaurants and bars, based on peak moments like major sporting or cultural events. Fixed pricing has evolved to dynamic models in places where people wouldn’t expect it.

Customer service is taking a hit, too. A third of the respondents to Accenture’s global survey say it’s been difficult to get help from or even reach customer service agents in the past year, and a National Customer Rage Survey revealed that US citizens’ experience of dealing with companies over problems is getting worse. They’re unimpressed with lackluster resolutions and have become more aggressive.

The potential revenue loss for businesses failing to manage complaints properly could reach US$887 billion, up from US$494 billion in 2020.

When customer service falls short, the small stones most customers can afford to throw at big companies in a battle for justice will simply bounce off. Services are starting to emerge to support customers with their grievances, from refunds for canceled flights to repairs under warranty.

Once hailed as a source of recurring revenue, subscriptions are becoming tedious to customers, and uptake is slowing down worldwide. People may become annoyed with subscriptions for products or services that shouldn’t need regular renewal—in some cases, the saving offered on subscription is clear, making it galling to pay more for a logical one-off purchase.

“Trying to leverage even more profit out of subscription services is a worrying trend and I hope there is a consumer backlash against it,” says Jack McKeown, motoring editor at The Courier.

People’s perception of purpose-led initiatives in today’s context is becoming less favorable. While it may not be this simple, customers can find it contradictory to see brands sinking money into surface-level support for a cause while shaving value off the experience they’re buying. Further, many of these messages are transparently insincere attempts to co-opt a current, high-profile cause, which often doesn’t reflect the brand.

In extreme cases, these actions polarize and alienate customers. They perceive that brands use purpose messaging to distract from measures to degrade their experience, helping to fuel anger over such campaigns.

It’s particularly damaging brands with mass appeal, who risk millions of dollars if they lose even a small percentage of customers. Whatever they do around purpose, companies could attract criticism from somewhere. Solving this is front of mind for CMOs, but is it too late to row back?

Brands have long been on a customer-obsession bandwagon, earnestly lauding the importance of their customer relationships. Now, people see them quietly reversing these promises and feel the impact on their finances and quality of life. Where’s the love that was such a priority a short while ago? Brands will need new strategies to present their value, and a new way to define and develop their relationship with their customers.

The extent to which people feel these have their best interest at heart:

This reveals a lack of trust across all sectors.

What’s Next

What’s Next

At the center of this trend is a critical perception problem: where companies see moves to ensure brand survival, some customers see greed. Most brands do what they must to remain viable in a difficult economy, but customers who don’t see behind the scenes often view those actions differently. For customers, it doesn’t make sense when essential service providers publish record profits after hiking rates, and this heightens their suspicions that other price rises, or quality compromises, are intended to short-change them.

Both brands and customers are having to reduce costs. If brands continue to offer customers less for more, resentment will quickly build and places like Reddit will become awash with dissatisfaction, fueling a negative impact on the brand’s long-term health, growth, and viability.

While consumer behaviors are complex, tweaking the dials on customer experience will impact brand desirability. Customers will always try to create their desired lifestyle. When finances are squeezed, their brand loyalty will become weaker, so price and value become the most influential levers. A major brand challenge becomes how to keep their product in people’s basket.

When pushed hard enough, more people might turn to illegal means to acquire what they want for a price they can justify. IPTV services, an illegal form of content piracy, have grown in popularity across Europe in response to prohibitively expensive subscriptions for sports programming.

While users may be relatively few, these behaviors often prompt larger shifts to combat them, just as Napster, a workaround for music fans, inspired the worldwide streaming model in place today.

Customers will continue to budget (as they’ve always had to do)—it’s almost inevitable that they’ll cancel subscriptions, cut back, trade down if they don’t feel the value. As they do, a new risk arises: the flip side of the concept of liquid expectations, “liquid suspicions” describes the idea that when customers are let down by one brand, they’ll be wary of all others.

Meaningful, competent customer experience will probably become a critical factor that defines their relationships with brands. They will only be persuaded by initiatives that earn trust through tangible support and stability. Discrepancy here is most evident in the declining efficacy of cause-led marketing, where risk of backlash can outweigh possible gain. For some brands, what was once a differentiator is now a hazard.

We expect to see the essentials of great marketing returning to brand strategy. When effectively managed to serve the customer, the four Ps of marketing—price, product, promotion, place—are a winning formula for growth, and a reminder that growing a brand means balancing value with sales volumes. Marketers appear to have been so focused on promotion, that the other Ps have fallen through the cracks—particularly price. Revisiting pricing with a careful eye on perceived value and fairness is key, as making considered sacrifices in margin could translate to gains in trust and loyalty.

Building a strong, trustworthy brand while trying to convert sales is the job of every marketer. The motional value of a brand can be an effective tool in times of economic difficulty. Companies like Airbnb and PepsiCo have found success by investing in brand, marketing, creativity, design, and storytelling, which has been attributed to a growth in sales.

Costco’s decision to keep prices steady yielded a 15 percent jump in sales in 2022’s third quarter. The retailer is maintaining loyalty and providing small moments of joy—just what’s needed in a recessionary climate.

Speaking to Canvas8 for the 2023 Expert Outlook, Karen Barnes, the editor of Delicious Magazine, said: “There is a need for security and comfort because people still want to have treats and small luxuries, even if they’re not the kind people would’ve had before.”

To rekindle customer loyalty, organizations must renew their focus on customer experience as a route to growth. Joint ownership of the experience should harness the best efforts of service, marketing, and design to deliver consistent value to customers. Successful collaborators will quickly discover the value of having an advocate for customer experience in efficiency discussions. The path forward means identifying and eliminating the breaking points that lead to resentment and returning to the four Ps of marketing to find new balance.

To rekindle customer loyalty, organizations must renew their focus on customer experience as a route to growth.

Authors: Mark Curtis, Global Sustainability and Thought Leadership Lead – Accenture Song; Katie Burke, Global Thought Leadership Lead – Accenture Song; Agneta Björnsjö, Global Research Lead – Accenture Song; Nick de la Mare, North America Design Lead – Accenture Song; and Alex Naressi, Managing Director, Global R&D Lead – Accenture Song.

To read or download the full report go to: https://www.accenture.com/ca-en/insights/song/accenture-life-trends?