By CB Insights

We share 3 predictions for how generative AI and agentic commerce will transform the experience across the 5 stages of the customer journey. Shopping could soon be as simple as saying “yes.”

Imagine: Your personal AI agent notifies you that a hair dryer you’ve been eyeing is now on sale. The product page highlights benefits tailored to your curly hair, while the agent confirms it will arrive before your upcoming trip.

With your approval, the agent handles the purchase through your secure wallet. Later, it proactively suggests complementary hair care products for the summer season.

This world of autonomous commerce isn’t as far off as it seems. Tech and e-commerce leaders — including OpenAI, Nvidia, Amazon, Walmart, Google, and Apple — are already building AI systems that are steps away from conducting transactions.

Advancements in generative AI have already started enabling hyper-personalized customer experiences that have driven increases in conversion rates, enabled smarter upselling, and streamlined operations.

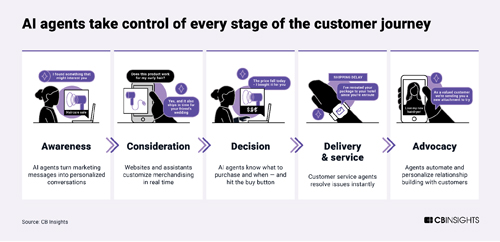

The traditional customer journey consists of 5 steps:

- Awareness: Discovering new products, brands, or businesses

- Consideration: Researching potential options or solutions

- Decision: Selecting and buying the preferred option

- Service: Using the product and accessing support

- Advocacy: Building loyalty and recommending to others

AI agents will impact each stage, streamlining the path to purchase and fundamentally transforming how businesses build relationships with consumers and drive loyalty.

We use CB Insights data on early-stage fundraising, public companies, and industry partnerships to analyze how generative AI — especially AI agents — is transforming the customer journey.

Across the 5 stages, 3 predictions emerge from our analysis:

- First-party transaction data will shape the future of AI-driven personalization. Effective marketing, advertising, and merchandising personalization relies on deep customer insights spanning transactions, preferences, and context. As personalization becomes more sophisticated at the awareness and consideration stages, companies with direct access to first-party data will have an edge. This data offers a richer understanding of customer preferences and behaviours, which will drive more informed personalization. Retailers, financial services firms, and digital wallet providers like Apple are well-positioned to capitalize on this shift.

- Direct-to-agent (D2A) commerce will kill traditional loyalty. With AI agents handling browsing and shopping, consumers can skip websites and brand pages altogether. Traditional loyalty programs will lose effectiveness as agents optimize shopping across a select group of merchants or deepen ties to specifi c businesses. To stay competitive, companies must rethink how they drive loyalty as purchases become increasingly automated — such as offering data-sharing incentives that enable AI agents to make better recommendations (e.g., sharing behind-the-scenes brand data on sustainability or product quality).

- A few AI agents will own the customer relationship. The exact agent model that will win out remains uncertain. However, companies like Amazon, Google, and Apple — with critical distribution and financial services infrastructure — are well-positioned in commerce. To stay competitive, consumer-facing businesses must build partnerships with big tech and other agent leaders or risk being excluded from consumers’ buying decisions.

First-party transaction data will shape the future of AI-driven personalization.

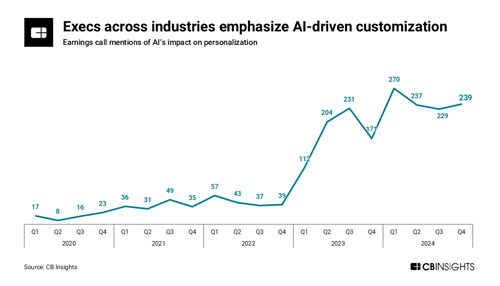

Mentions of AI’s impact on personalization have surged in earnings calls over the last two years as marketers, brands, and merchants prioritize instantly digesting reams of consumer data. Brands, merchants, and other businesses that can feed AI personalization tools with first-party transaction data will be in the driver’s seat across the customer journey. AI agents are turning marketing messages into personalized conversations.

Ad leaders already use generative AI to drive awareness via personalized end-to-end campaigns, aggregating creative assets, brand messaging, and customer data. For instance:

- Early in 2024, the CEO of global marketing fi rm Omnicom Group discussed the company’s new tool, ArtBotAI — a content platform that collects clients’ creative assets, brand messaging, and customer data to generate personalized ads and other content.

- Similarly, in September 2024, food giant Mondelez International launched a platform in partnership with Accenture and Publicis Groupe to create personalized text, images, and videos for the company’s brands.

But agents will take brand messaging a step further by transforming formerly one-way marketing into full conversations.

Firsthand, founded by former TV and digital advertising executives, offers one vision for that next phase. The company’s solution includes not only a platform that gives brands more control over AI’s use of their content but also generative marketing agents that enable on-site customized conversations between brands and consumers.

For instance, after reading about a particular topic, a consumer could immediately converse with an agent from an advertiser to learn more about its related solutions.

AI generates unique online “stores” for every customer

Customer data and AI tools are also powering the next stage in complete personalization: generating unique online “stores” for each consumer.

Walmart is leading this charge. In late 2024, the retailer announced plans to create unique home pages for each shopper visiting its website by predicting what customers want to see based on their preferences.

Meanwhile, enterprise search companies and startups are expanding their use of large language models (LLMs) — not only to deliver more precise search results but also to enhance and personalize the e-commerce experience with generative AI.

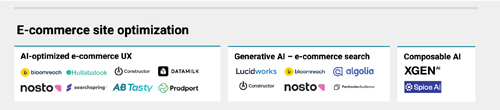

- AI-optimized e-commerce UX solutions focus on personalizing the entire front-end shopping experience — from product pages to sponsored content — to boost conversion and engagement.

- Generative AI – e-commerce search leverages AI to interpret user intent, deliver more relevant results, and enable natural language interactions (e.g., chatbots) on e-commerce platforms.

- Composable AI is a broader technology framework that provides modular, interchangeable AI components (e.g., NLP, computer vision) that can be combined and scaled for various use cases beyond e-commerce.

These shifts toward hyper-personalized marketing and merchandising only elevate the position of companies with robust transaction data, particularly retailers and financial services companies.

These companies can connect consumers’ buying habits across platforms (online and in stores) and maintain transparency about the collection and use of that data. This development could put media networks from retailers and other consumer-facing businesses (e.g., Uber or PayPal) on an equal footing with ad network giants.

For companies without first-party data, data-sharing partnerships will be critical — for instance, with financial services firms, shared merchant loyalty networks, or e-commerce platforms providing insights to marketplace sellers. Incorporating contextual data, such as location, referral sources, and engagement patterns, will enable more sophisticated targeting.

Direct-to-agent (D2A) commerce will kill traditional loyalty

Once shoppers arrive at their customized homepages, AI assistants will evolve to be their personalized shopping companions, learning individual consumer preferences to anticipate needs and guide purchases.

Consumers’ gradual reliance on agents will lead them to skip brands or retailers entirely. In direct-to-agent commerce, the advantage will be with the agent that can most quickly learn and act on a consumer’s habits and preferences.

AI assistants become personal shoppers

Major retailers are already launching their own smart shopping assistants that are making shopping support continuous, personalized, and efficient:

- Amazon’s Rufus (launched February 2024) answers product questions using information from reviews and external sources.

- Walmart’s Customer Support Assistant now recognizes returning online shoppers and can perform tasks like finding orders and managing returns.

- Target’s Store Companion helps store employees answer on-the-job questions, train new team members, and support store operations.

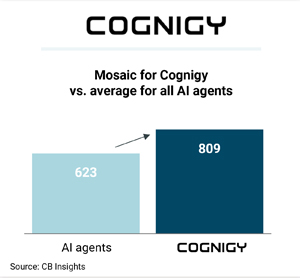

At the same time, customer support agent companies are developing even deeper capabilities. Germany-based Cognigy, which raised $100M in June 2024, offers AI agents that can simultaneously handle tens of thousands of customer conversations across retail, airlines, and banking. While primarily focused on contact center support, its agents can also offer recommendations, product searches, re-engage abandoned carts, and more before purchase.

At the same time, customer support agent companies are developing even deeper capabilities. Germany-based Cognigy, which raised $100M in June 2024, offers AI agents that can simultaneously handle tens of thousands of customer conversations across retail, airlines, and banking. While primarily focused on contact center support, its agents can also offer recommendations, product searches, re-engage abandoned carts, and more before purchase.

Cognigy’s advances are notable: in the broadly nascent AI agent landscape, the company’s CB Insights Mosaic health score is significantly higher than the average for agents overall, pointing to Cognigy’s traction:

The next wave of shopping agents will be able to alert consumers about price drops on items they want, suggest products that match their style, or even automatically reorder items they regularly use.

But prompting product discovery — and acquiring new customers — will become increasingly difficult as customers become entrenched with their agents.

In response, merchants and brands will need to find new or alternate channels to influence potential buyers’ buying decisions and the information that agents gather to make decisions. This means more focus on niche media platforms, user-generated content, cross-industry partnerships, message boards, and more.

Agents automate and personalize relationship-building with customers

Long-established loyalty-driving tools like special offers will also have to evolve as consumers’ interactions with brands and other consumer businesses narrow.

For instance, cross-platform AI agents will strengthen rewards across merchants, negotiating the best combinations of rewards and offers on consumers’ behalf.

Smart wallet Kudos demonstrates this shift — it automatically selects the credit card offering the highest rewards per purchase and recommends new cards based on users’ spending habits. The company raised a $10M Series A round in May 2024. Programs like Kudos’ could also help strengthen retention by identifying likely churn before it happens and taking automated steps to re-engage program members.

Smart wallet Kudos demonstrates this shift — it automatically selects the credit card offering the highest rewards per purchase and recommends new cards based on users’ spending habits. The company raised a $10M Series A round in May 2024. Programs like Kudos’ could also help strengthen retention by identifying likely churn before it happens and taking automated steps to re-engage program members.

A few AI agents will own the customer relationship

Perhaps the most significant step will be for agents to understand consumers’ preferences, anticipate their needs, and complete transactions.

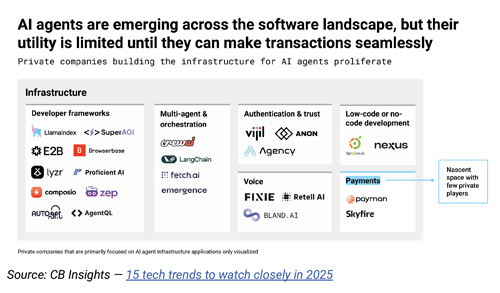

While the universe of startups creating AI agent infrastructure is rapidly expanding — 100+ companies are developing agent applications from marketing to customer support — big tech and AI companies with native AI infrastructure, established financial services, and digital wallet capabilities are well-positioned to lead broader adoption of agents overall, and more specifically of agentic commerce.

AI agents know what to purchase and when — and hit the buy button

AI giants have opened the door to agent-led buying. In January 2025, OpenAI introduced its agent Operator, which uses its own browser to perform tasks, interacting with the web independently on users’ behalf. The tasks can include everything from filling out forms to placing online orders.

So far, users have reported that Operator often needs backup — such as help entering login information or getting through bot-tracking tools like CAPTCHAs — and can act with too much independence, adding fees for tips or fast delivery without permission.

But big tech companies are close behind. Google and Amazon have both discussed expanding the reach of their AI assistants to perform more shopping tasks. At the same time, Apple is developing its AI suite, Apple Intelligence, as a tool that could eventually reach into apps and other functionality on Apple’s devices to perform user tasks. The company’s strong privacy focus and robust wallet infrastructure give it a distinct advantage in this emerging field.

One wild card to enable fully agentic buying: controlling agents’ buying power.

Early movers in payments are developing solutions for payment rails and digital wallets where users can restrict the funds available to agents. Coinbase Ventures-backed Skyfi re is targeting agent-to-agent transactions using crypto wallets. Its platform assigns each AI agent a digital wallet where a user can deposit a set amount of funds that can be used for a purchase.

While early in its deployment, the company has begun processing payments between AI agents and businesses, including LLM aggregators and large-scale financial services. Skyfi re is among the few companies in the nascent market for companies concentrating on building AI infrastructure for payments.

In November 2024, Stripe launched a similar service called Stripe Issuing, which allows developers to generate single-use virtual cards with spend controls that agents can use to make purchases. AI search platform Perplexity is using Stripe’s single-issuing capability to power its new “Buy with Pro” agentic commerce service.

Even as big tech and payments leaders pull ahead, a key question remains for agentic commerce: Will consumers use agents tied to specific retailers or platforms (e.g., Amazon’s Rufus) or independent agents that can work across merchants and platforms (e.g., OpenAI’s Operator or Google’s Gemini)? For example, an independent agent could book airline tickets directly, bypassing upsell attempts from airlines offering seat upgrades.

Amid this uncertainty, consumer-facing businesses — from merchants to banks — should partner with AI agent infrastructure leaders now. This approach not only ensures their digital platforms are optimized for AI but also lays the groundwork for developing their own agents.

CB Insights is a platform that provides market intelligence and analysis, particularly focusing on private companies, startups, and their investors. It’s a valuable resource for individuals and organizations in fields like private equity, venture capital, and corporate strategy who need to stay informed about emerging technologies, market trends, and competitor activities. This article is based on a research paper about the future of the customer journey. www.cbinsights.com